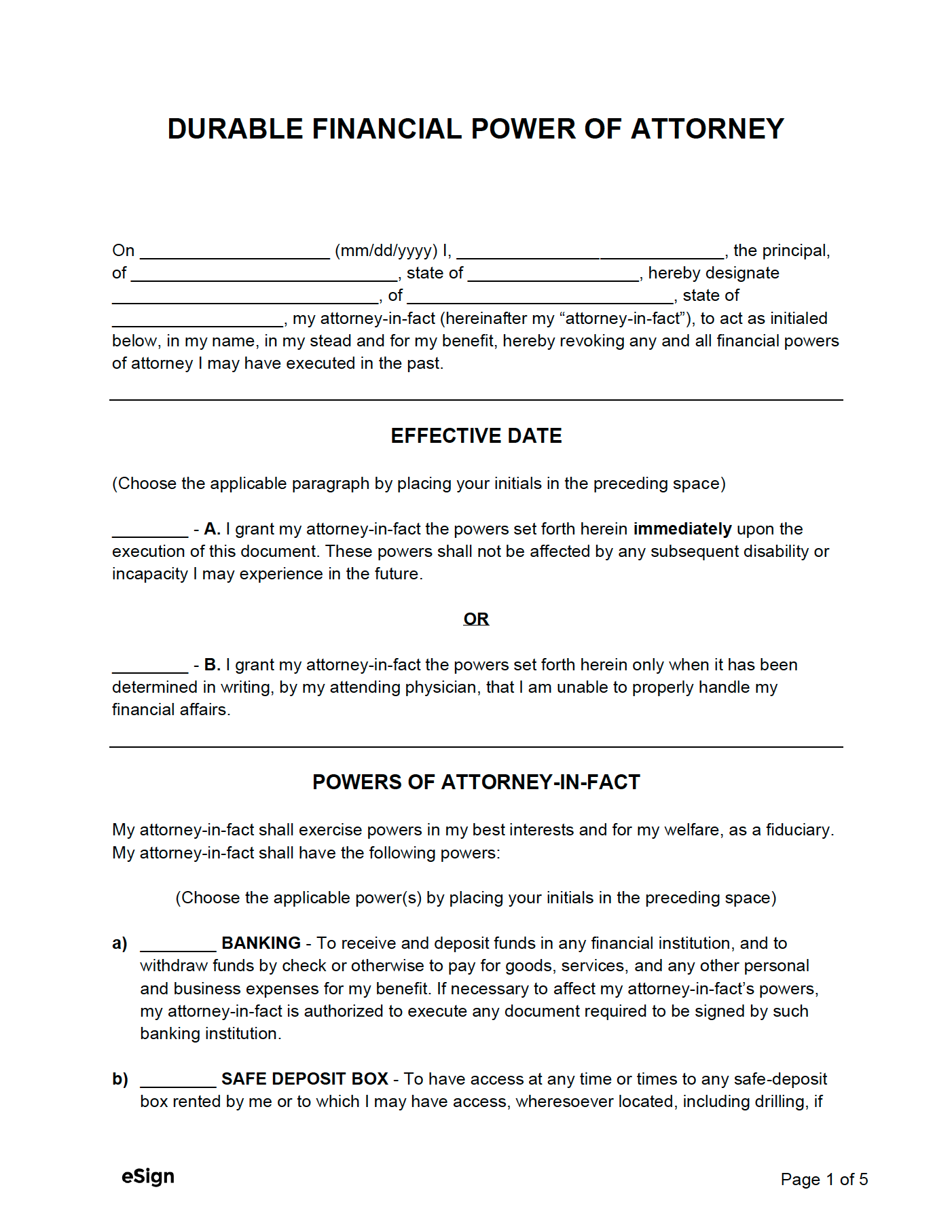

A Durable Financial Power of Attorney (DPOA) is a legal document that empowers someone you trust to make financial decisions on your behalf, especially if you become incapacitated or unable to manage your own affairs. This can be crucial in situations like accidents, illnesses, or cognitive decline.

Key Components of a Durable Financial Power of Attorney Form

Grantor: The person creating the DPOA.

Image Source: esign.com

Benefits of a Durable Financial Power of Attorney

Peace of Mind: Knowing that your financial affairs will be handled responsibly in case of an emergency.

Creating a Durable Financial Power of Attorney

1. Choose an Agent: Select someone you trust implicitly to handle your financial matters. Consider their financial knowledge, trustworthiness, and availability.

2. Consult an Attorney: An attorney can help you draft a DPOA that meets your specific needs and complies with local laws. They can also advise you on any potential risks or limitations.

3. Execute the DPOA: Sign and date the document in the presence of witnesses and a notary public.

Conclusion

A Durable Financial Power of Attorney is a valuable tool for protecting your financial interests and ensuring that your affairs are managed according to your wishes. By creating this document, you can provide peace of mind for yourself and your loved ones.

FAQs

1. Can I revoke my Durable Financial Power of Attorney? Yes, you can revoke your DPOA at any time, as long as you are mentally competent.

2. What if my agent becomes incapacitated or dies? You may want to consider appointing a successor agent to take over your financial affairs.

3. Can a Durable Financial Power of Attorney be used to make healthcare decisions? No, a DPOA only covers financial matters. For healthcare decisions, you would need a separate document, such as a healthcare power of attorney.

4. Can I limit the powers granted to my agent? Yes, you can specify the exact scope of your agent’s authority in the DPOA.

5. Is a Durable Financial Power of Attorney required by law? While not mandatory in all jurisdictions, having a DPOA can provide significant benefits and peace of mind.

Durable Financial Power Of Attorney Form