Proforma invoices are a valuable tool for businesses to provide potential clients with a detailed estimate of goods or services before a contract is signed. By creating a clear and professional proforma invoice, you can increase your chances of securing a sale and improving your business’s reputation.

Essential Elements of a Proforma Invoice

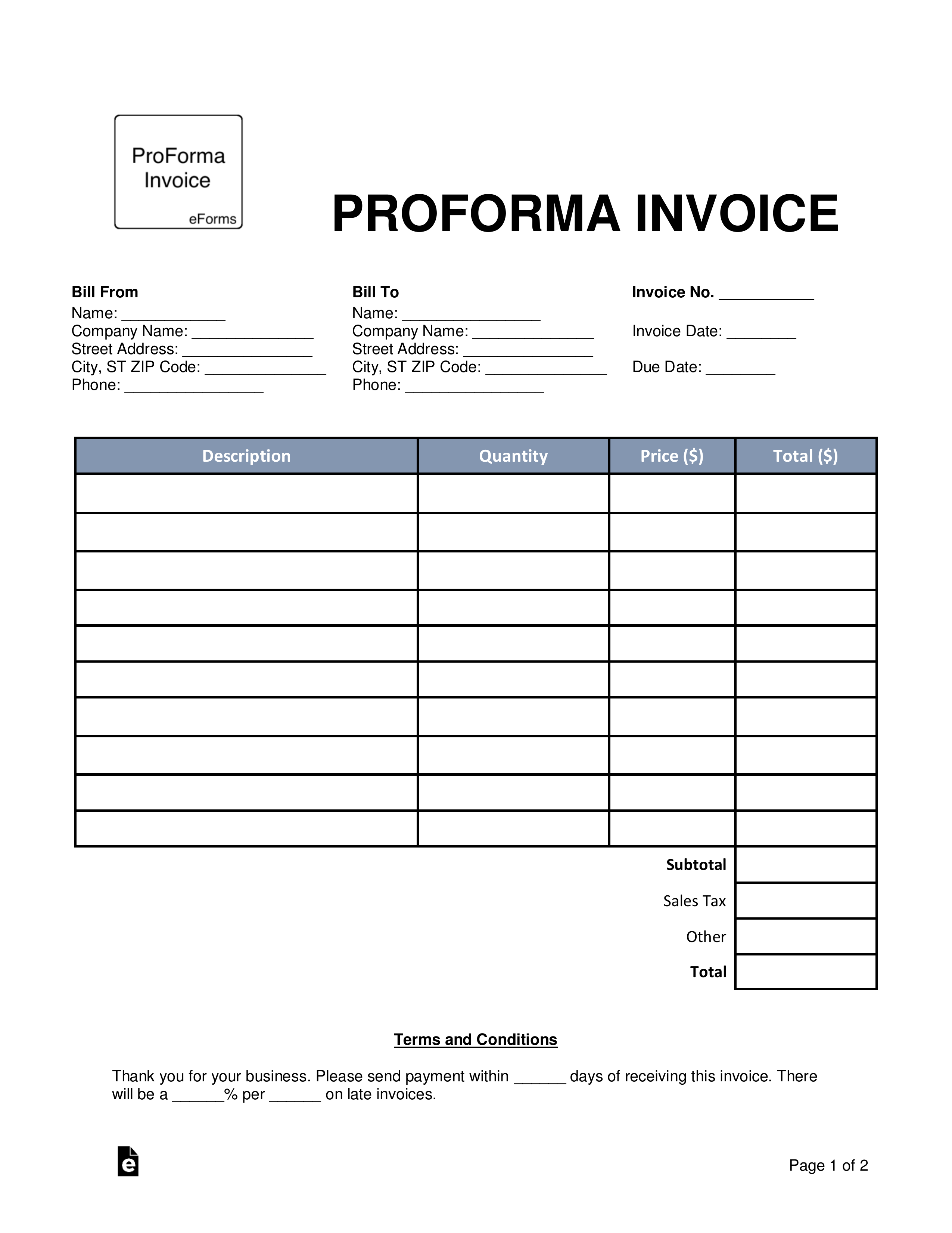

1. Company Information: Include your company’s name, address, contact information, and logo.

2. Invoice Number: Assign a unique number to each proforma invoice for easy tracking.

3. Date: Specify the date the invoice was issued.

4. Customer Information: List the customer’s name, address, and contact information.

5. Invoice Terms: Clearly state the payment terms, such as due date and accepted payment methods.

6. Itemized List of Goods or Services: Provide a detailed description of each item, including quantity, unit price, and total cost.

7. Subtotal: Calculate the total cost of goods or services.

8. Taxes: If applicable, indicate the tax rate and amount.

9. Shipping or Handling Charges: Add any additional costs for shipping or handling.

10. Total: Calculate the final amount due.

Image Source: eforms.com

Creating a Professional Proforma Invoice

To create a professional proforma invoice, consider using a template or invoice software. This will help you ensure that your document is formatted correctly and includes all the necessary elements.

Tips for Effective Proforma Invoices:

Be Clear and Concise: Use clear and concise language to avoid confusion.

Conclusion

By following these guidelines, you can create professional proforma invoices that help you win new business and improve your company’s bottom line. Remember to customize your invoices to meet the specific needs of your business and your customers.

FAQs

1. What is the difference between a proforma invoice and a regular invoice? A proforma invoice is a preliminary document that provides an estimate of goods or services before a contract is signed, while a regular invoice is issued after the goods or services have been delivered or completed.

2. Can I use a proforma invoice as a receipt? No, a proforma invoice cannot be used as a receipt. A receipt is a document that confirms that payment has been received.

3. Do I need to include a signature on a proforma invoice? While not strictly necessary, including a signature can add a personal touch and make the document more official.

4. Can I use a proforma invoice to track inventory? No, a proforma invoice is not designed for inventory tracking. For inventory tracking, you should use a separate system.

5. What should I do if a customer disputes a proforma invoice? If a customer disputes a proforma invoice, you should review the document carefully to ensure that all the information is correct. If you find any errors, you should issue a corrected invoice. If the dispute is over the price or terms of the agreement, you may need to negotiate with the customer.

Proforma Invoice Sample