What is a Contractor Invoice?

A contractor invoice is a formal document issued by a contractor to a client, detailing the services provided, the cost of those services, and any applicable taxes. It’s essentially a bill for work completed.

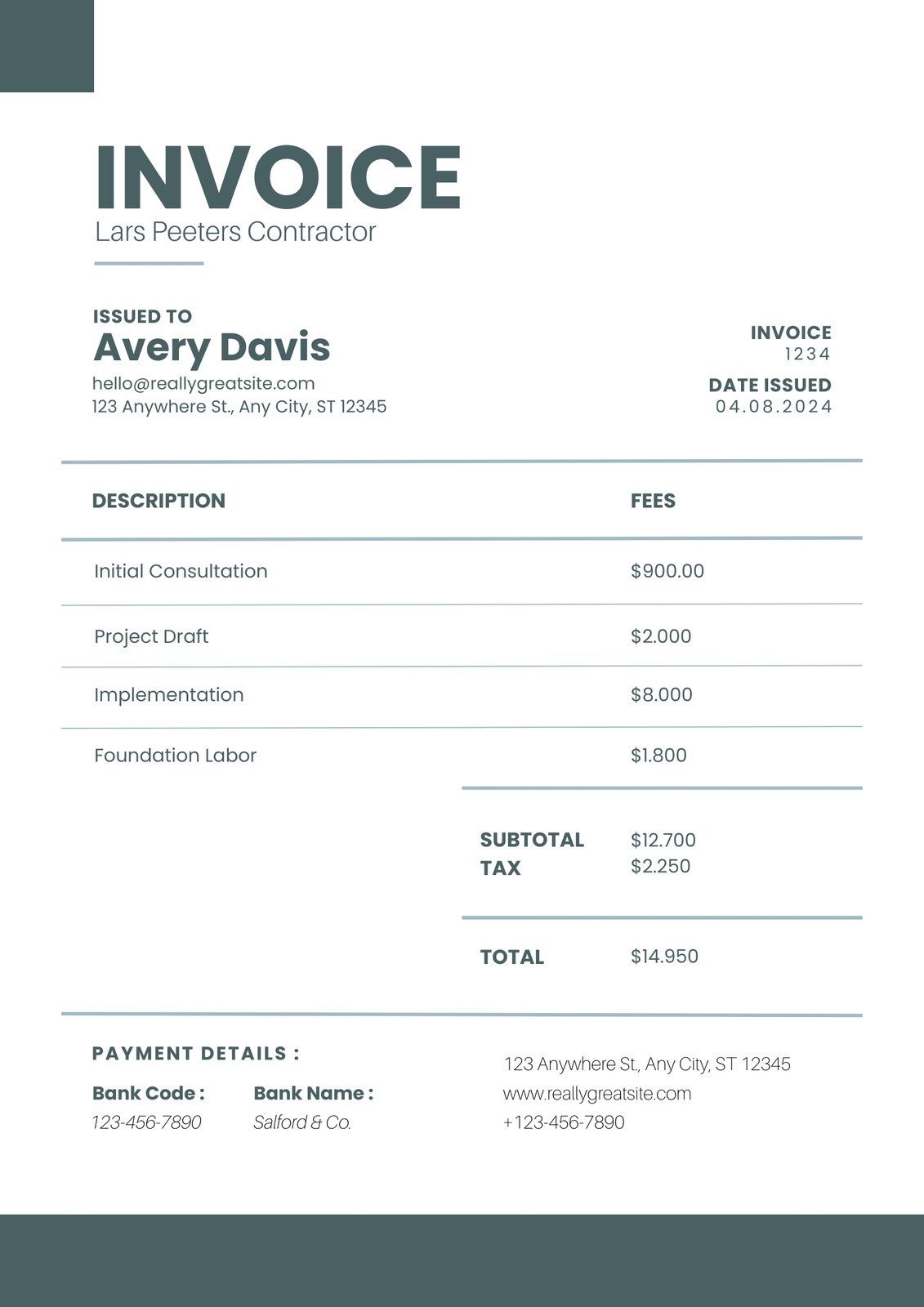

Key Components of a Contractor Invoice

Image Source: canva.com

1. Invoice Number: A unique identifier for the invoice.

2. Invoice Date: The date the invoice was issued.

3. Client Information: The name, address, and contact information of the client.

4. Contractor Information: The name, address, and contact information of the contractor.

5. Description of Services: A detailed list of the services performed, including quantities and rates.

6. Total Amount Due: The sum of all charges, including taxes.

7. Payment Terms: The due date and acceptable payment methods.

8. Contractor Signature: The signature of the contractor authorizing the invoice.

Example Contractor Invoice

Invoice Number: INV-001

Invoice Date: September 12, 2024

Client: John Doe

Contractor: ABC Contracting

Description of Services:

Total Amount Due: $4100

Payment Terms: Due within 30 days of invoice date.

Contractor Signature: [Signature]

Conclusion

A well-structured contractor invoice is essential for clear communication and efficient billing. By following the guidelines outlined above, you can create professional invoices that accurately reflect the services provided and facilitate timely payment.

FAQs

1. What is the difference between an invoice and a quote?

2. Can I include additional charges on a contractor invoice?

3. What should I do if a client disputes an invoice?

4. How often should I send invoices to my clients?

5. What is the best way to collect payment on an invoice?

Sample Contractor Invoice