What is a Construction Invoice?

A construction invoice is a formal document that details the services provided and the costs incurred for a construction project. It’s essentially a bill that a contractor sends to a client.

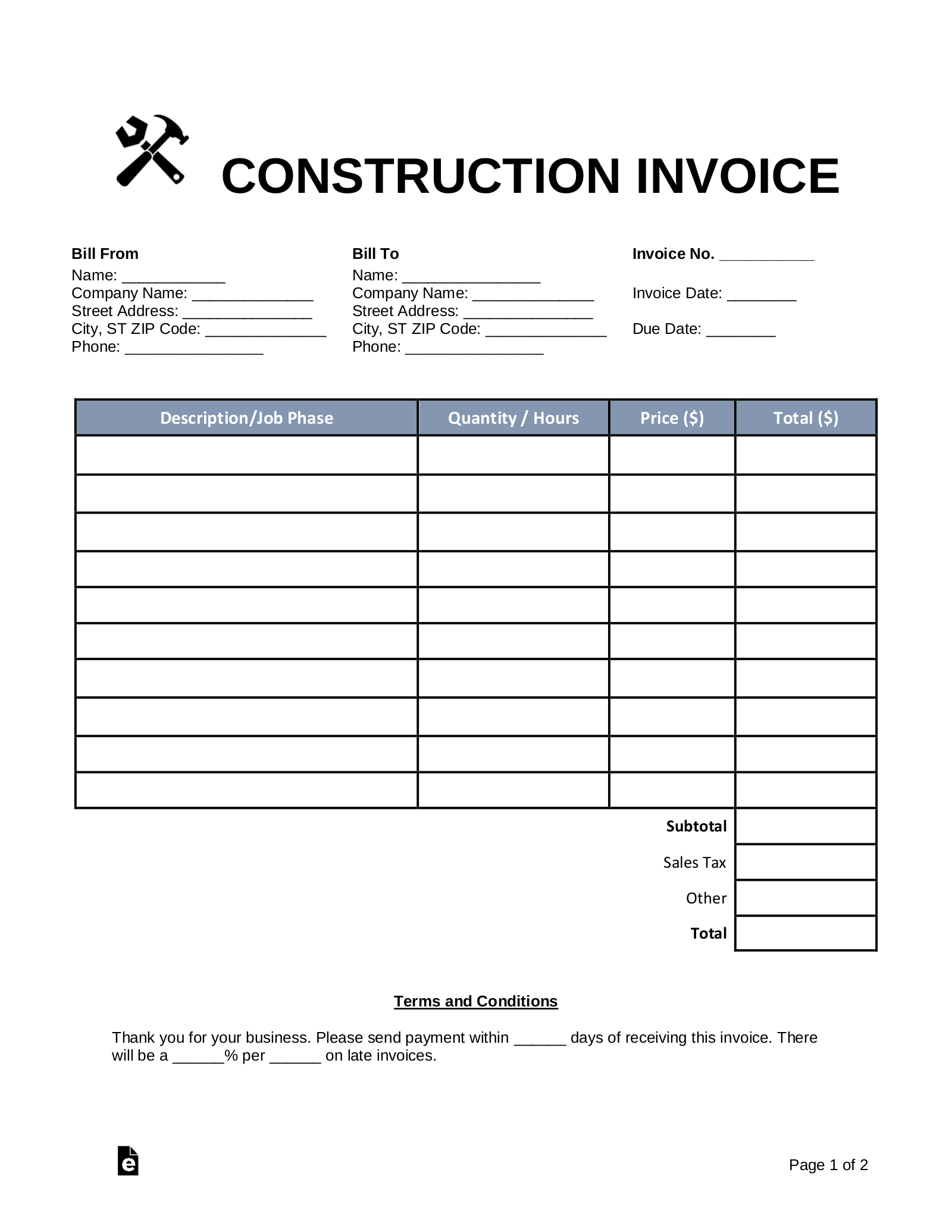

Key Components of a Construction Invoice

Image Source: eforms.com

1. Invoice Number: A unique identifier for the invoice.

2. Invoice Date: The date the invoice is issued.

3. Project Name or Number: A reference to the specific construction project.

4. Client Information: The name, address, and contact details of the client.

5. Contractor Information: The name, address, and contact details of the contractor.

6. Itemized List of Services: A detailed breakdown of the services provided, including quantities, rates, and total costs.

7. Subtotal: The total cost before taxes or discounts.

8. Taxes: Any applicable sales or value-added taxes.

9. Discounts: Any discounts or credits applied.

10. Total Due: The final amount owed by the client.

11. Payment Terms: The due date and acceptable payment methods.

Creating a Construction Invoice

To create a construction invoice, you can use:

Invoice Software: Specialized software that automates the process.

Tips for Effective Invoicing

Be Clear and Concise: Ensure the invoice is easy to read and understand.

Conclusion

A well-crafted construction invoice is essential for accurate billing and efficient project management. By following the key components and tips outlined above, you can create professional invoices that help you get paid on time.

FAQs

1. What is the difference between a progress invoice and a final invoice? A progress invoice is sent during the project to request payment for work completed to date, while a final invoice is issued upon project completion and includes the total amount owed.

2. Can I include additional charges on a construction invoice? Yes, you can include additional charges such as change orders, material markups, or permits. However, these charges should be clearly itemized and justified.

3. How often should I send progress invoices? The frequency of progress invoices depends on the project’s terms and the client’s preferences. Generally, monthly or bi-monthly invoices are common.

4. What should I do if a client disputes an invoice? If a client disputes an invoice, review the documentation carefully and try to resolve the issue amicably. If necessary, you may need to consult with an attorney.

5. Are there any legal requirements for construction invoices? While there may not be specific legal requirements for construction invoices in all jurisdictions, it’s always a good practice to comply with local laws and regulations regarding invoicing and taxation.

Sample Construction Invoice