What is a Consulting Invoice?

A consulting invoice is a formal document that outlines the services provided by a consultant, the rates charged, and the total amount due. It’s essentially a bill for the work completed.

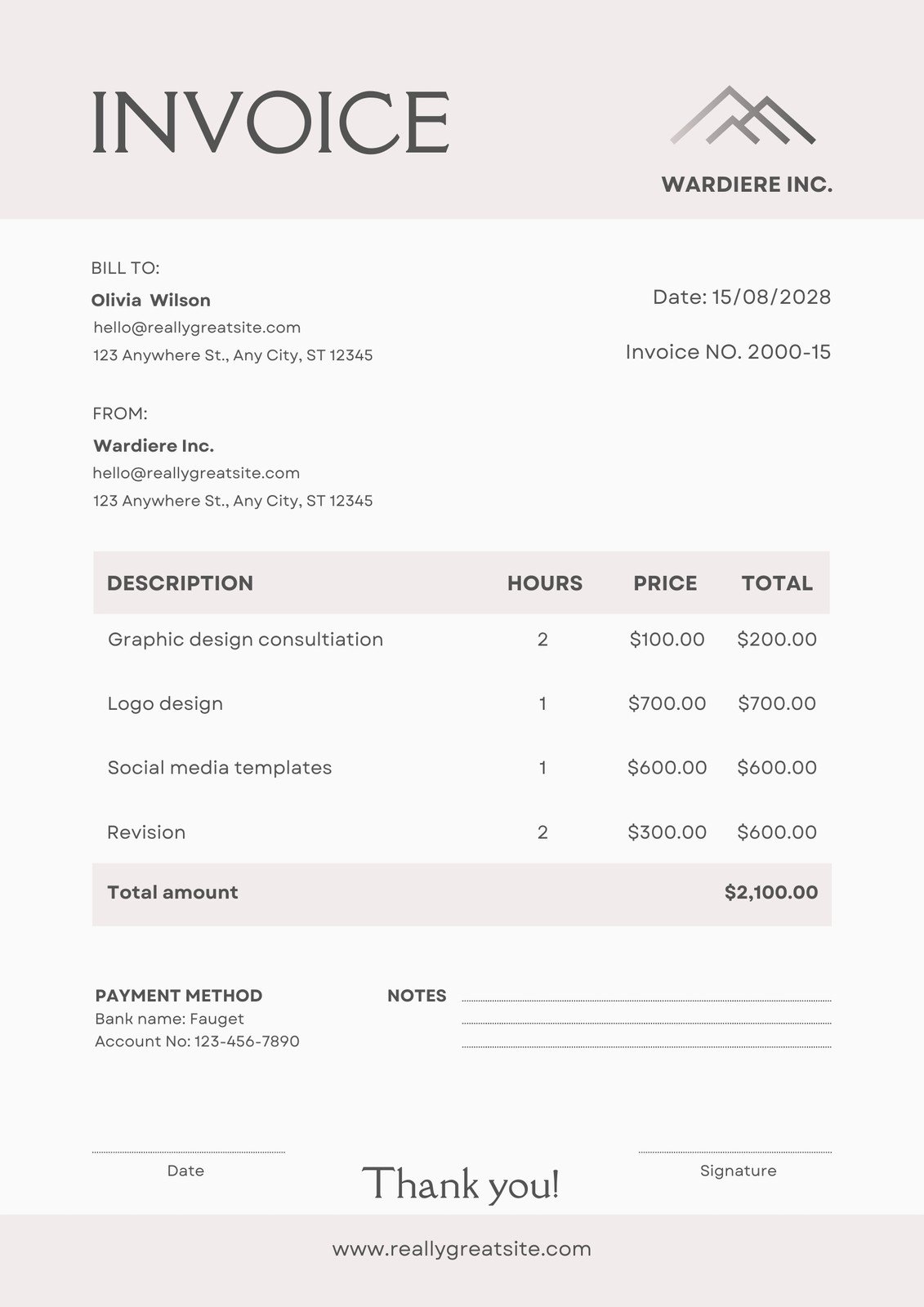

Key Components of a Consulting Invoice

Image Source: canva.com

1. Consultant Information: This section includes the consultant’s name, business name, contact information, and tax identification number (TIN).

2. Client Information: Similar to the consultant information, this section provides the client’s name, business name, contact information, and any relevant project details.

3. Invoice Number: A unique identifier for the invoice.

4. Invoice Date: The date the invoice is issued.

5. Due Date: The date by which the payment is expected.

6. Itemized List of Services: A detailed breakdown of the services provided, including descriptions and hourly rates.

7. Total Hours Worked: The cumulative time spent on the project.

8. Total Amount Due: The final cost of the services, including any applicable taxes.

9. Payment Terms: The preferred method of payment and any associated fees or discounts.

10. Signature Line: A space for the consultant to sign and date the invoice.

Tips for Creating a Professional Consulting Invoice

Be Clear and Concise: Use simple language and avoid technical jargon.

Conclusion

A well-crafted consulting invoice is a crucial tool for managing your business finances and building professional relationships with clients. By following the guidelines outlined above, you can create invoices that are easy to understand, accurate, and professional.

FAQs

1. What is the best software for creating consulting invoices? There are many options available, including popular accounting software like QuickBooks and FreshBooks, as well as online invoice generators.

2. Can I include additional fees on my consulting invoice? Yes, you can include additional fees such as travel expenses, materials costs, or late payment penalties.

3. How often should I send invoices to my clients? The frequency of invoicing depends on the terms of your agreement with the client. Generally, it’s best to send invoices monthly or weekly for ongoing projects.

4. What should I do if a client disputes my invoice? If a client disputes your invoice, it’s important to address their concerns promptly and professionally. You may need to provide additional documentation or negotiate a resolution.

5. Can I offer discounts or payment plans to my clients? Yes, you can offer discounts or payment plans to attract clients and improve your cash flow. However, it’s important to carefully consider the potential impact on your profitability.

Sample Consulting Invoice