QuickBooks Invoice Sample

If you’re a small business owner, chances are you’ve heard of QuickBooks. It’s a popular accounting software that can help you manage your finances, including creating invoices. But what exactly does a QuickBooks invoice look like? Let’s break it down.

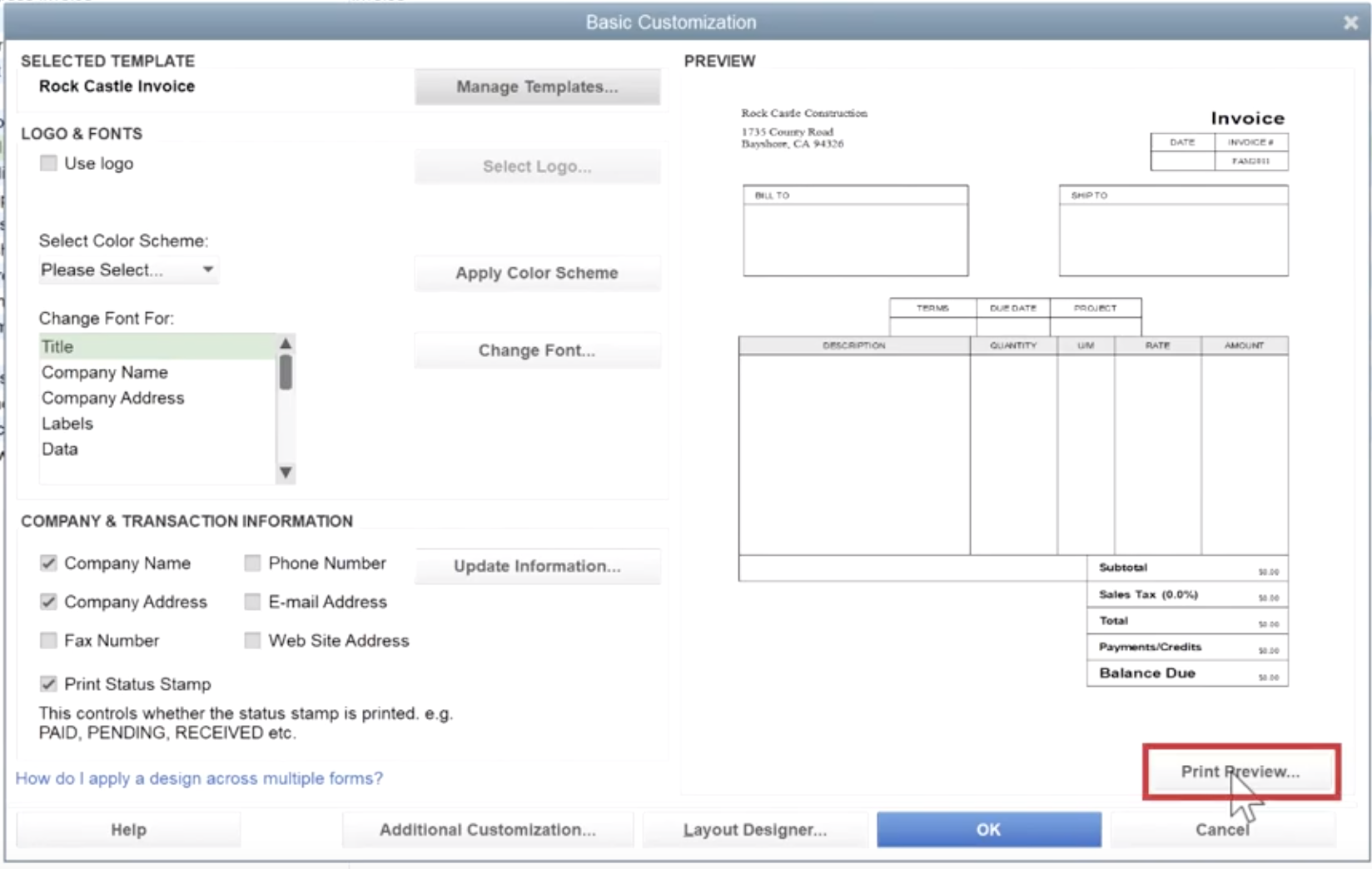

Essential Elements of a QuickBooks Invoice

Image Source: gentlefrog.com

1. Invoice Number: This is a unique identifier for each invoice you create.

2. Invoice Date: The date the invoice was issued.

3. Due Date: The date by which the payment is expected.

4. Customer Information: This includes the customer’s name, address, and contact information.

5. Itemized List of Products or Services: This section details the items or services provided, their quantity, unit price, and total cost.

6. Subtotal: The total cost of the items or services before taxes.

7. Tax: The amount of sales tax or other taxes applicable.

8. Total: The final amount due, including the subtotal and taxes.

9. Payment Terms: The terms under which the payment is expected (e.g., net 30 days).

10. Business Information: Your business name, address, and contact information.

Creating a QuickBooks Invoice

1. Open QuickBooks.

2. Go to the “Customers” menu.

3. Select “Create Invoice.”

4. Enter the customer’s information.

5. Add the items or services.

6. Review the invoice and make any necessary adjustments.

7. Print or email the invoice.

Tips for Effective Invoices

Be clear and concise. Use simple language and avoid technical jargon.

Conclusion

Creating professional invoices is crucial for any business. QuickBooks makes it easy to generate invoices that are both visually appealing and informative. By following the tips outlined in this guide, you can ensure that your invoices are effective and help you get paid on time.

FAQs

1. Can I customize the look of my QuickBooks invoices? Yes, you can customize the appearance of your invoices by adding your logo, changing the colors, and modifying the layout.

2. Can I accept online payments through QuickBooks? Yes, QuickBooks integrates with various payment gateways, allowing you to accept online payments directly from your invoices.

3. How can I track the status of my invoices? QuickBooks provides tools to track the status of your invoices, including whether they have been paid, partially paid, or are overdue.

4. Can I create recurring invoices in QuickBooks? Yes, you can set up recurring invoices for customers who have regular billing cycles.

5. Is there a free version of QuickBooks? QuickBooks offers a variety of pricing plans, including some that are free for small businesses with limited needs.

Quickbooks Invoice Sample