Why You Need a Monthly Bills Template

A monthly bills template can be a lifesaver when it comes to managing your finances. It helps you stay organized, track your spending, and identify areas where you can save money. Whether you’re a student, a working professional, or a parent, a monthly bills template can be a valuable tool.

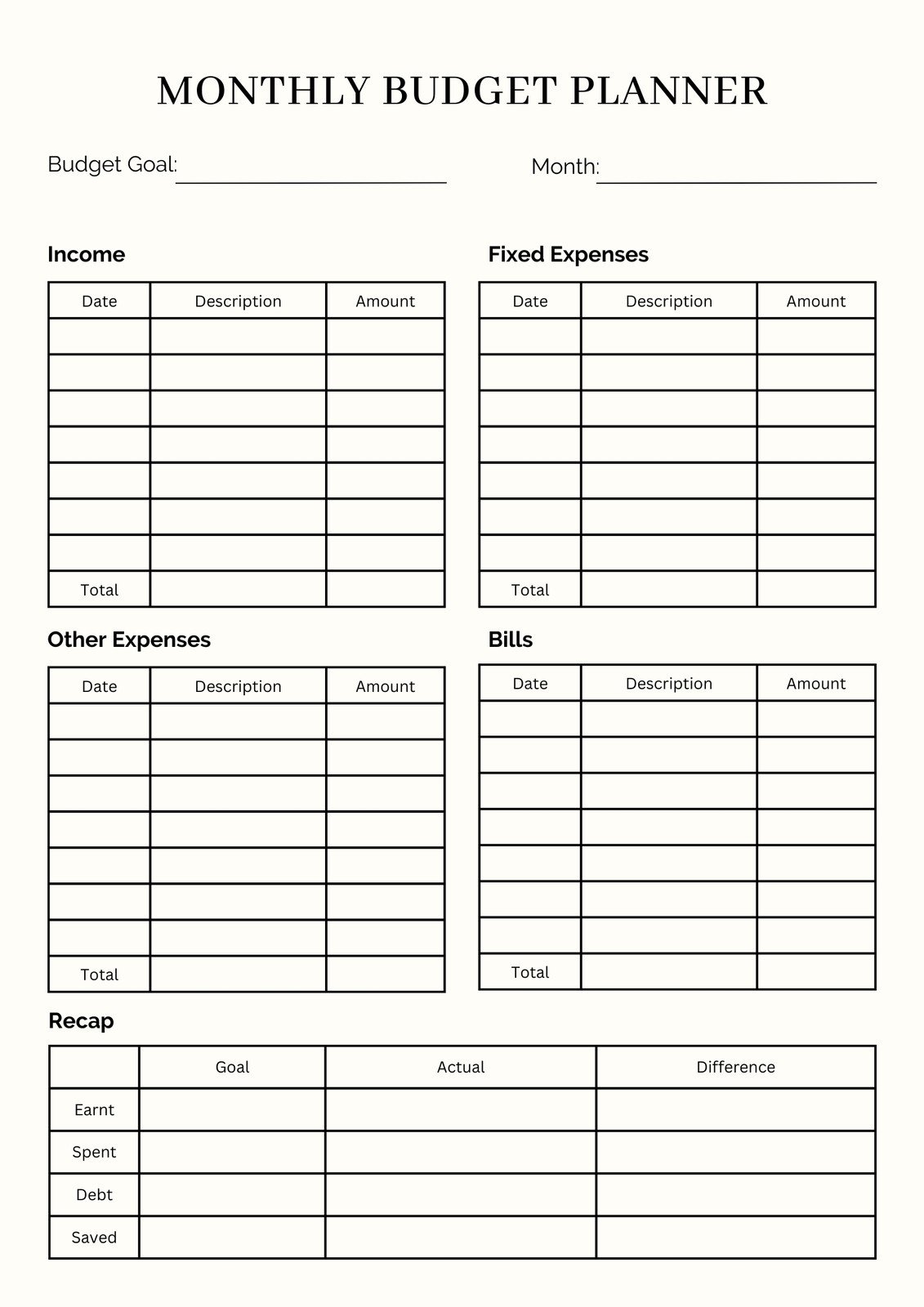

Creating Your Monthly Bills Template

Image Source: canva.com

1. Gather Your Bills: Start by collecting all of your monthly bills. This includes everything from your rent or mortgage to your utility bills, car payments, and credit card statements.

2. Choose a Format: You can create your monthly bills template on paper, in a spreadsheet, or using a budgeting app. The most important thing is to choose a format that works best for you and that you’ll actually use.

3. List Your Bills: Create a list of all your monthly bills. Include the due date, the amount due, and the payment method (e.g., automatic payment, check, or online payment).

4. Track Your Payments: As you make payments, mark them off on your template. This will help you stay on top of your bills and avoid late fees.

5. Review Your Spending: Once you’ve been using your monthly bills template for a few months, take some time to review your spending. Look for areas where you can cut back and save money.

Tips for Using Your Monthly Bills Template

Be Consistent: Use your monthly bills template every month to get the most out of it.

Conclusion

A monthly bills template is a simple but effective tool for managing your finances. By using a template, you can stay organized, track your spending, and identify areas where you can save money. Give it a try and see how it can help you improve your financial situation.

FAQs

1. What should I include in my monthly bills template?

2. How often should I review my monthly bills template?

3. Can I use a budgeting app instead of a monthly bills template?

4. How can I save money using a monthly bills template?

5. What if I miss a bill payment?

Monthly Bills Template