What is an LLC Operating Agreement?

Think of an LLC operating agreement as a roadmap for your business. It’s a legal document that outlines how your limited liability company (LLC) will be run. It covers everything from who owns the company to how profits and losses are divided.

Key Elements of an LLC Operating Agreement

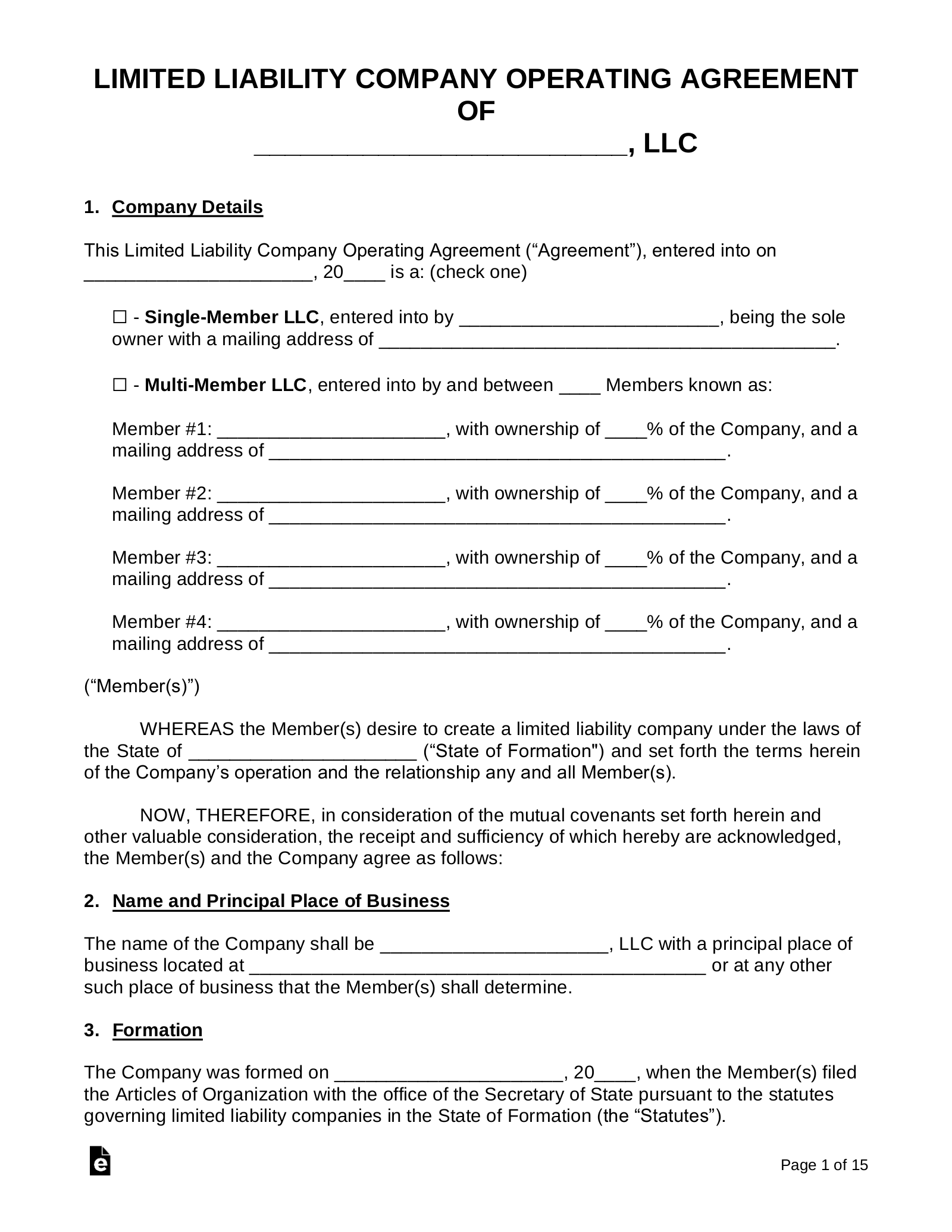

Image Source: eforms.com

Members and Ownership: This section details who owns the LLC and their percentage of ownership.

Example Operating Agreement Sections

Article I: Name and Purpose

Tips for Writing Your LLC Operating Agreement

1. Keep it Simple: Avoid legal jargon that you or your members might not understand.

2. Be Specific: The more detailed your agreement, the better it will protect your LLC.

3. Consider Consulting a Lawyer: While you can create a basic operating agreement yourself, consulting a lawyer can ensure that it complies with all legal requirements.

Conclusion

An LLC operating agreement is a crucial document for any limited liability company. It provides a framework for how your business will operate and helps protect your personal assets. By understanding the key elements and following the tips above, you can create a comprehensive and effective operating agreement for your LLC.

FAQs

1. Is an LLC operating agreement required by law? While not required in all states, having an operating agreement is highly recommended as it provides legal protection and clarifies the rights and responsibilities of members.

2. Can I change my LLC operating agreement after it’s been signed? Yes, you can amend your operating agreement at any time. However, it’s important to follow the procedures outlined in the original agreement.

3. What happens if there is a disagreement among members of the LLC? The operating agreement should address how disputes will be resolved, such as through mediation or arbitration.

4. Can I transfer my ownership interest in the LLC to someone else? Yes, you can transfer your ownership interest, but this may be subject to certain restrictions outlined in the operating agreement.

5. What happens if a member of the LLC dies? The operating agreement should specify how the deceased member’s ownership interest will be handled, such as through a buy-sell agreement.

Llc Operating Agreement Example