Living Trust Template

A living trust, also known as a revocable trust, is a legal document that allows you to transfer ownership of your assets to a trustee during your lifetime. This trustee will manage your assets according to your wishes, even if you become incapacitated. Once you pass away, the assets will be distributed to your beneficiaries as specified in the trust.

Key Benefits of a Living Trust

Image Source: eforms.com

Avoid Probate: Probate can be a lengthy and costly process. A living trust can help you bypass probate, saving your loved ones time and money.

Creating a Living Trust Template

While it’s possible to create a living trust template yourself, it’s highly recommended to consult with an attorney to ensure that your document is legally sound and meets your specific needs. An attorney can also help you understand the complexities of estate planning and provide personalized advice.

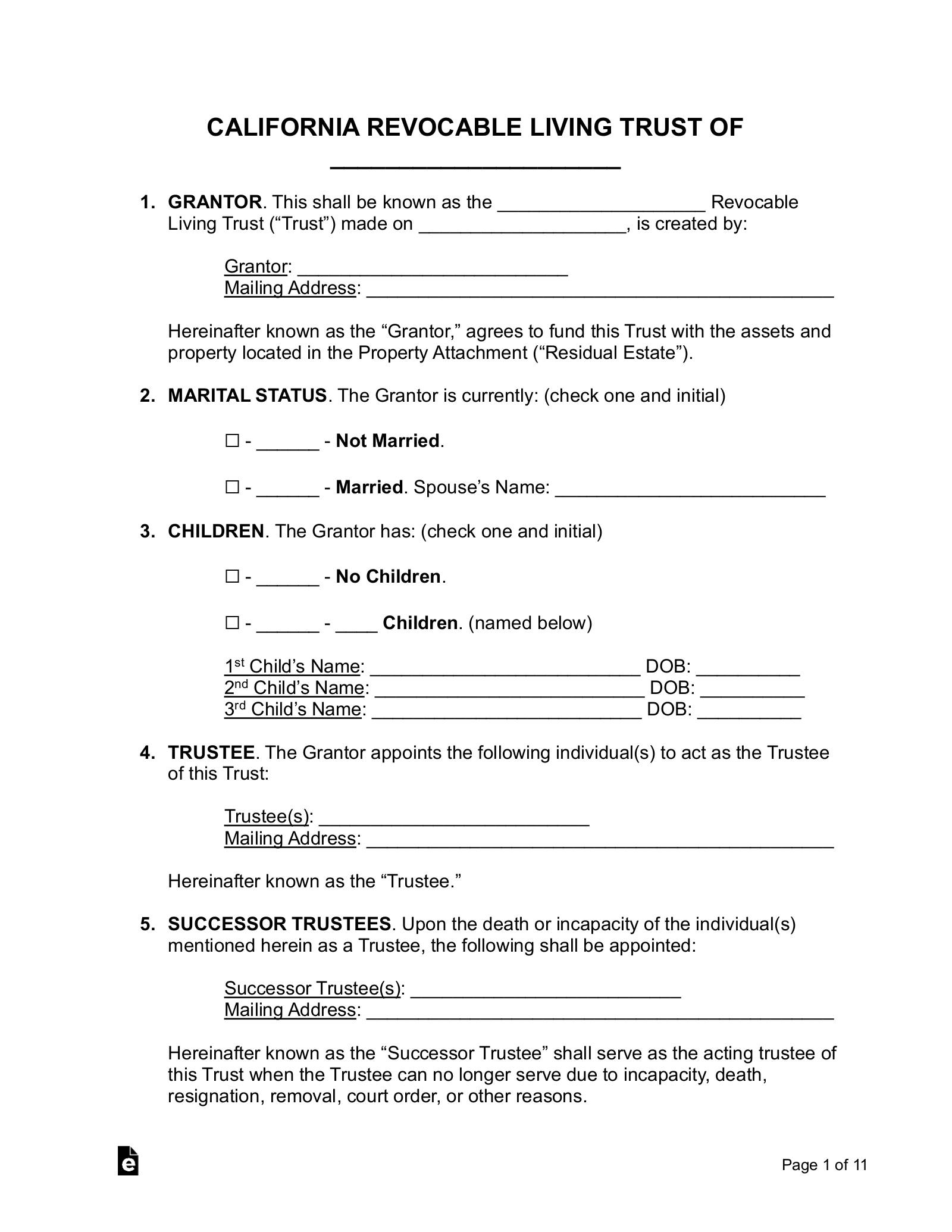

Essential Components of a Living Trust Template

1. Identification of the Settlor: This section should clearly state the name and address of the person creating the trust.

2. Grant of Trust Property: This section outlines the assets that will be transferred to the trust.

3. Appointment of Trustee: You will need to name one or more individuals or entities to serve as trustees.

4. Statement of Purpose: This section explains the reasons for creating the trust.

5. Grant of Powers to Trustee: This section grants the trustee the necessary authority to manage and distribute the trust assets.

6. Succession of Trustee: This section outlines what will happen if the original trustee becomes incapacitated or dies.

7. Distribution Provisions: This section specifies how the trust assets will be distributed to your beneficiaries after your death.

8. Revocation Clause: This clause allows you to revoke or modify the trust during your lifetime.

9. Pour-Over Will: A pour-over will can be used to ensure that any assets not included in the trust will be transferred to the trust upon your death.

Conclusion

A living trust can be a valuable tool for estate planning and asset protection. By consulting with an attorney and creating a well-crafted trust document, you can ensure that your wishes regarding the distribution of your assets are carried out as intended.

FAQs

1. What is the difference between a revocable and irrevocable trust? A revocable trust can be modified or revoked during your lifetime, while an irrevocable trust cannot.

2. Can I name myself as the trustee of my living trust? Yes, you can. However, it’s often advisable to name a trusted friend or family member as the trustee to avoid potential conflicts of interest.

3. Do I need to update my living trust if my circumstances change? Yes, it’s important to review and update your living trust periodically to ensure that it reflects your current wishes and circumstances.

4. Can a living trust help protect my assets from creditors? In some cases, a living trust can help protect your assets from creditors. However, the effectiveness of a trust in this regard depends on various factors, including state law and the specific circumstances of your case.

5. Is a living trust expensive to create? The cost of creating a living trust can vary depending on the complexity of your estate and the fees charged by your attorney. However, the potential benefits of a trust can often outweigh the initial costs.

Living Trust Template