Living Trust Template

A living trust, also known as a revocable trust, is a legal document that allows you to transfer ownership of your assets to a trustee while you’re still alive. This trustee will manage your assets according to your wishes, even if you become incapacitated or pass away.

Why Create a Living Trust?

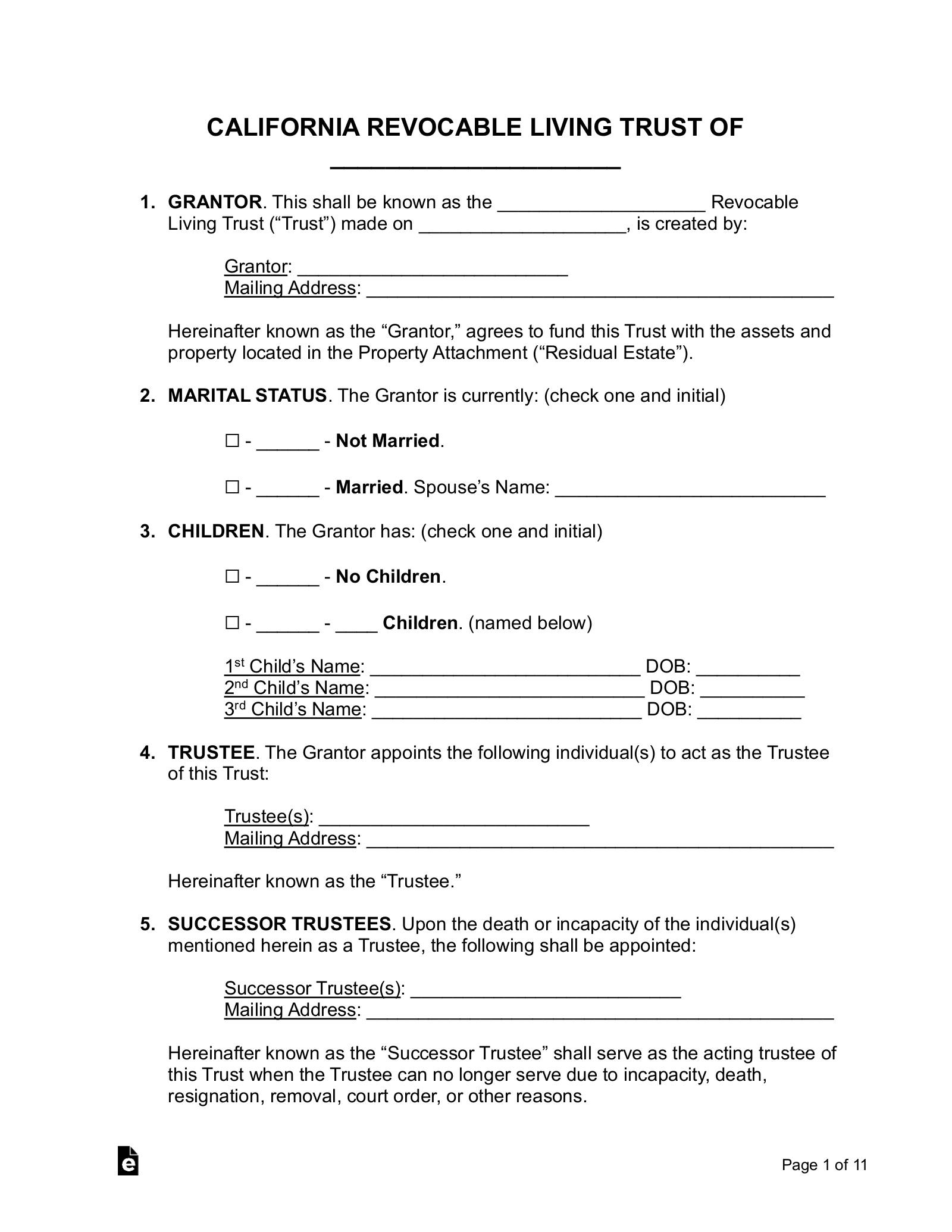

Image Source: eforms.com

1. Avoid Probate: Probate can be a lengthy and costly process. A living trust can help you bypass probate, saving your loved ones time and money.

2. Estate Planning: A living trust can help you plan for your estate, ensuring that your assets are distributed according to your wishes.

3. Asset Protection: In some cases, a living trust can help protect your assets from creditors or lawsuits.

Key Components of a Living Trust Template

1. Grantor: The person creating the trust.

2. Trustee: The person or entity responsible for managing the trust assets.

3. Beneficiaries: The individuals or organizations who will receive the trust assets.

4. Trust Property: The assets that will be transferred to the trust.

5. Successor Trustee: A person or entity who will take over as trustee if the original trustee becomes incapacitated or dies.

Creating Your Living Trust Template

While you can find free living trust templates online, it’s often recommended to consult with an attorney to ensure that your trust meets your specific needs and complies with local laws. An attorney can also help you understand the potential tax implications of creating a living trust.

Conclusion

A living trust can be a valuable tool for estate planning and asset protection. By understanding the key components of a living trust and consulting with an attorney, you can create a document that will help you achieve your goals.

FAQs

1. Can I change my living trust after it’s created? Yes, you can typically amend or revoke your living trust at any time during your lifetime.

2. What assets should I include in my living trust? You can include a variety of assets in your living trust, such as real estate, bank accounts, investments, and personal belongings.

3. Do I need a lawyer to create a living trust? While it’s possible to create a living trust without a lawyer, consulting with an attorney can help ensure that your trust is legally sound and meets your specific needs.

4. How often should I review my living trust? It’s generally recommended to review your living trust every few years to make sure it still aligns with your goals and reflects any changes in your circumstances.

5. Can a living trust help me avoid estate taxes? In some cases, a living trust can help you reduce your estate taxes. However, it’s important to consult with a tax professional to determine the potential tax implications of creating a living trust.

Living Trust Template