What is Invoicing?

Think of an invoice as a receipt, but it’s more formal and detailed. It’s a document you send to a customer after they’ve received your goods or services. It outlines the specific items they purchased, the total cost, and when the payment is due.

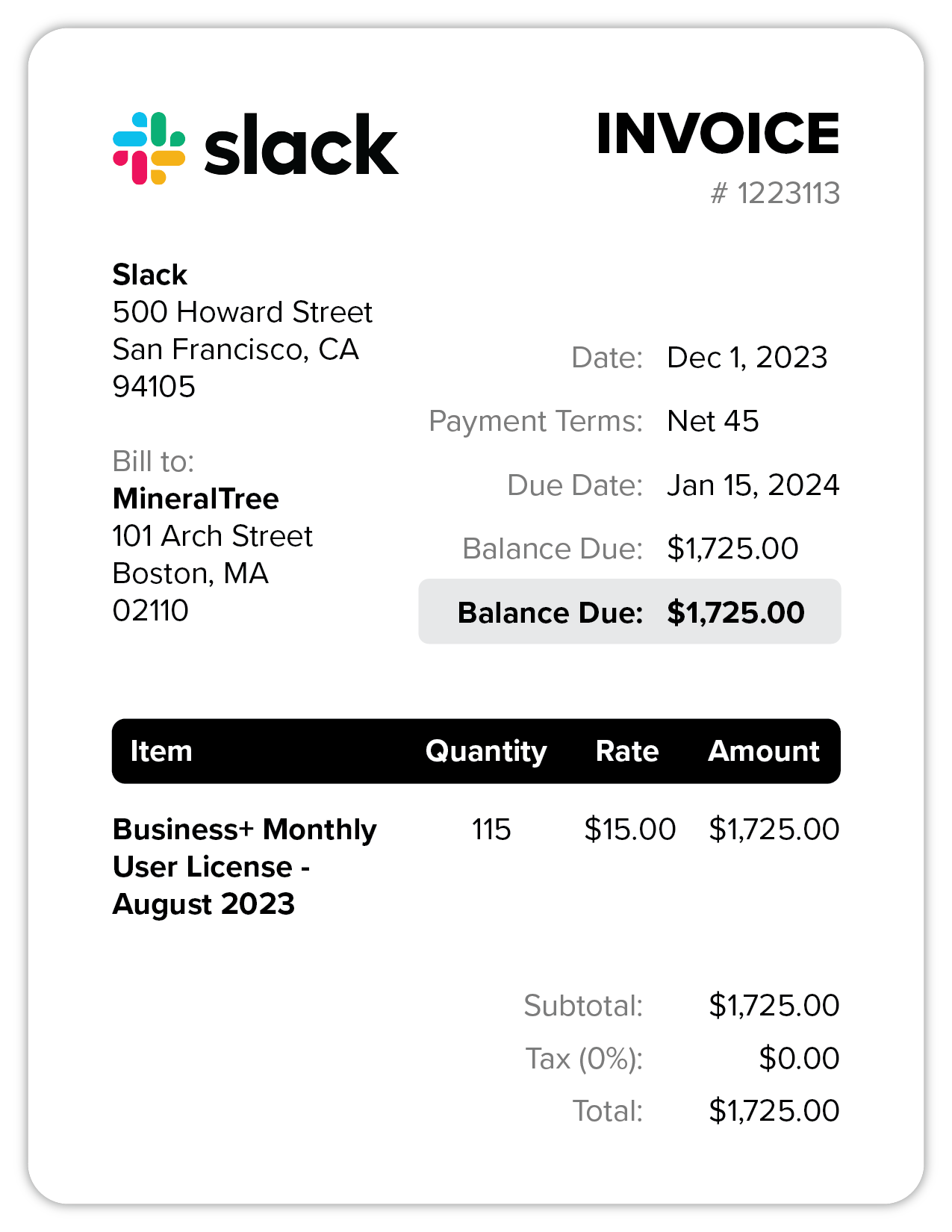

Key Components of an Invoice

Image Source: mineraltree.com

Popular Payment Methods

Tips for Effective Invoicing

Conclusion

Invoicing is a crucial aspect of running a business. By creating clear and accurate invoices, you can improve your cash flow and build trust with your customers. By following the tips outlined in this guide, you can streamline your invoicing process and ensure timely payments.

FAQs

1. What is the difference between an invoice and a receipt? An invoice is a formal document that outlines the goods or services provided and the total cost, while a receipt is typically a simpler document that confirms a payment.

2. How often should I send invoices? Generally, invoices should be sent promptly after providing goods or services. The specific frequency may vary depending on your industry and business practices.

3. Can I charge interest on late payments? Yes, you can typically charge interest on late payments. However, it’s important to clearly state your late payment policy on your invoices.

4. What should I do if a customer doesn’t pay on time? If a payment is overdue, you should send a reminder and follow up as necessary. If the payment remains unpaid, you may need to take legal action.

5. What are some common invoicing mistakes to avoid? Common mistakes include errors in the customer’s information, unclear payment terms, and delayed invoice sending.

Invoicing Payments