What is a Financial Power of Attorney?

A Financial Power of Attorney (FPOA) is a legal document that grants someone you trust the authority to manage your financial affairs on your behalf. This can be crucial if you become incapacitated or unable to handle your own finances.

Why You Need a Financial Power of Attorney

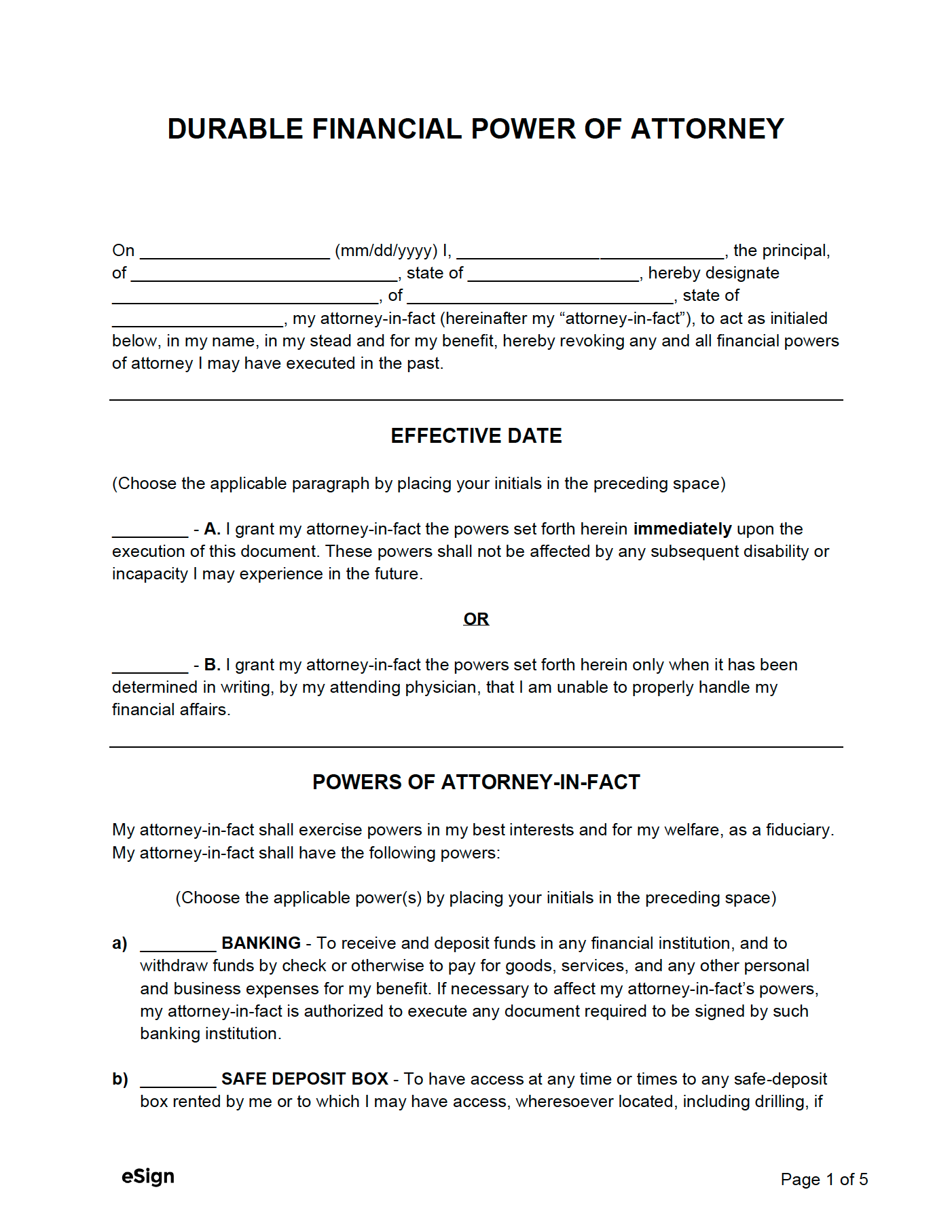

Image Source: esign.com

Incapacity: If you become ill or injured and can’t make financial decisions, an FPOA ensures someone you trust can pay your bills, manage your investments, and handle other financial matters.

Key Components of a Financial Power of Attorney

1. Grantor: The person granting the power of attorney.

2. Agent: The person appointed to act on the grantor’s behalf.

3. Scope of Authority: The specific actions the agent is authorized to perform. This can include paying bills, managing investments, selling property, and more.

4. Duration: The length of time the power of attorney is effective. It can be a specific period or until the grantor’s death.

5. Springing Power of Attorney: This type of FPOA becomes effective only if the grantor becomes incapacitated.

Creating Your Financial Power of Attorney

1. Consult an Attorney: While you can find FPOA templates online, it’s highly recommended to consult an attorney to ensure the document is legally sound and meets your specific needs.

2. Choose an Agent: Carefully select someone you trust to handle your financial matters. Consider their financial knowledge and experience.

3. Define the Scope of Authority: Clearly outline the specific actions you want your agent to be able to perform.

4. Consider a Springing Power of Attorney: If you want the FPOA to become effective only if you become incapacitated, choose a springing power of attorney.

5. Sign and Witness: Ensure the document is properly signed and witnessed according to your state’s laws.

Conclusion

A Financial Power of Attorney is a vital legal document that can provide peace of mind and protect your financial interests. By understanding the key components and following the steps outlined above, you can create a FPOA that meets your needs and ensures your financial affairs are well-managed.

FAQs

1. Can I revoke my Financial Power of Attorney? Yes, you can revoke your FPOA at any time, as long as you are mentally competent.

2. What if I disagree with my agent’s decisions? If you have concerns about your agent’s actions, you should consult with an attorney to discuss your options.

3. Can my agent use the FPOA for their own benefit? No, your agent is only authorized to use the FPOA for your benefit.

4. Do I need a separate FPOA for each state? If you have assets in multiple states, you may need separate FPOAs for each state.

5. Can I appoint more than one agent? Yes, you can appoint multiple agents to act on your behalf. However, it’s important to clearly define their roles and responsibilities.

Financial Power Of Attorney Template