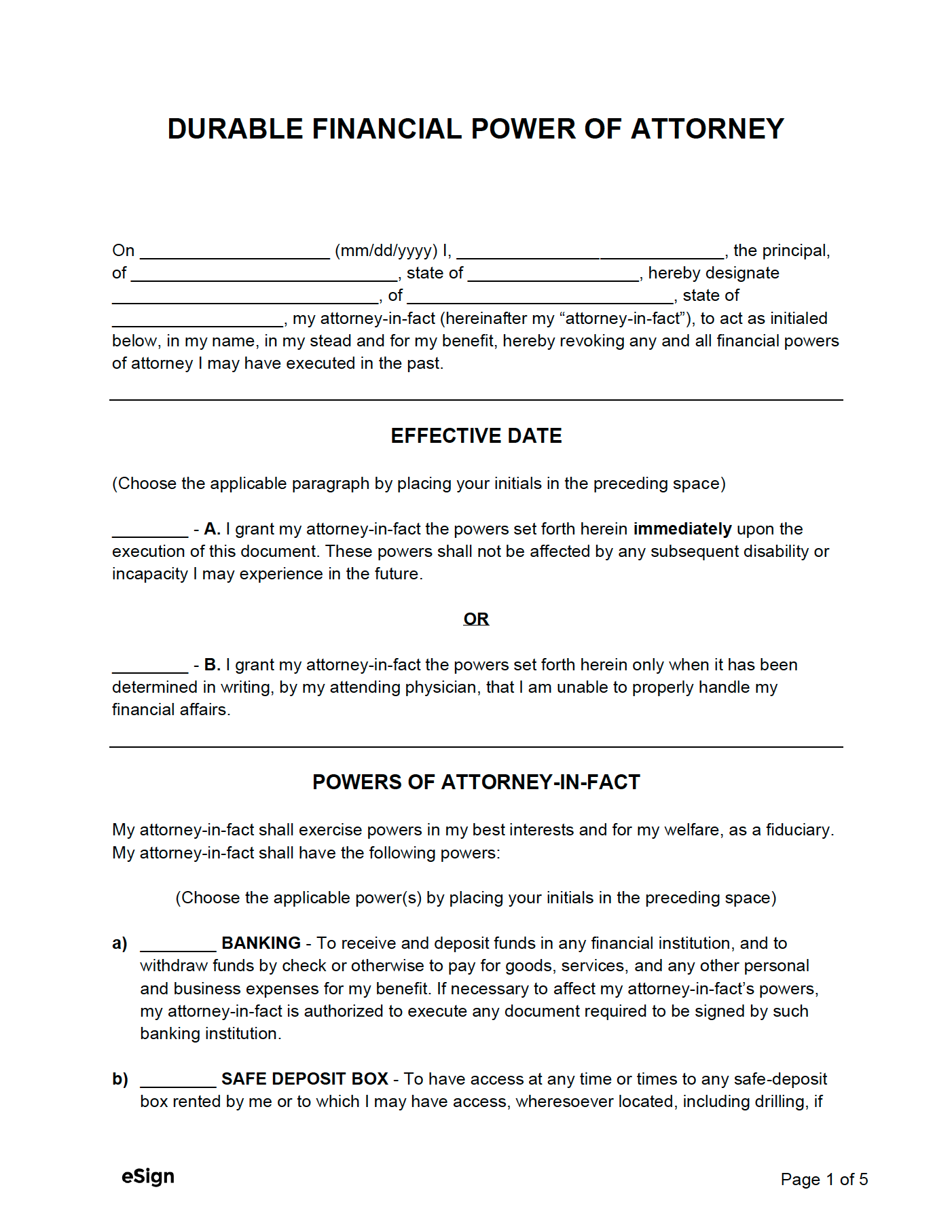

A Durable Financial Power of Attorney (DPOA) is a legal document that empowers someone you trust to make financial decisions on your behalf if you become unable to do so. This could happen due to illness, injury, or other circumstances.

Key Provisions of a Durable Financial Power of Attorney:

Grant of Authority: This section specifies the types of financial decisions your agent can make, such as paying bills, managing investments, and signing contracts.

Image Source: esign.com

How to Create a Durable Financial Power of Attorney:

1. Choose an Agent: Select someone you trust to handle your financial affairs. Consider their financial knowledge and experience.

2. Consult with an Attorney: An attorney can help you create a DPOA that meets your specific needs and complies with local laws.

3. Execute the Document: Sign and date the DPOA in the presence of witnesses and a notary public.

Conclusion:

A Durable Financial Power of Attorney is a crucial legal document that can provide peace of mind and protect your financial interests. By carefully considering your agent and the provisions of the DPOA, you can ensure that your finances are well-managed even if you are unable to handle them yourself.

FAQs:

1. What is the difference between a Durable Power of Attorney and a General Power of Attorney? A Durable Power of Attorney remains in effect even if you become incapacitated, while a General Power of Attorney may terminate if you become unable to make decisions.

2. Can I revoke my Durable Power of Attorney? Yes, you can revoke your DPOA at any time by providing written notice to your agent and the relevant parties.

3. Can my agent use my DPOA to make gifts or donations? The ability of your agent to make gifts or donations depends on the specific provisions of your DPOA.

4. Should I consider a Springing Power of Attorney? A Springing Power of Attorney can provide additional protection by ensuring that your agent only takes control of your finances if you are declared mentally incompetent.

5. How often should I review my Durable Power of Attorney? It’s a good idea to review your DPOA periodically to ensure that it still meets your needs and reflects any changes in your circumstances.

Durable Financial Power Of Attorney Form