What is a Sales Receipt?

A sales receipt is a document issued by a seller to a buyer as proof of a transaction. It typically includes details such as the date, items purchased, quantity, price, and total amount paid. While not legally required in many jurisdictions, sales receipts are essential for record-keeping, accounting, and potential returns or exchanges.

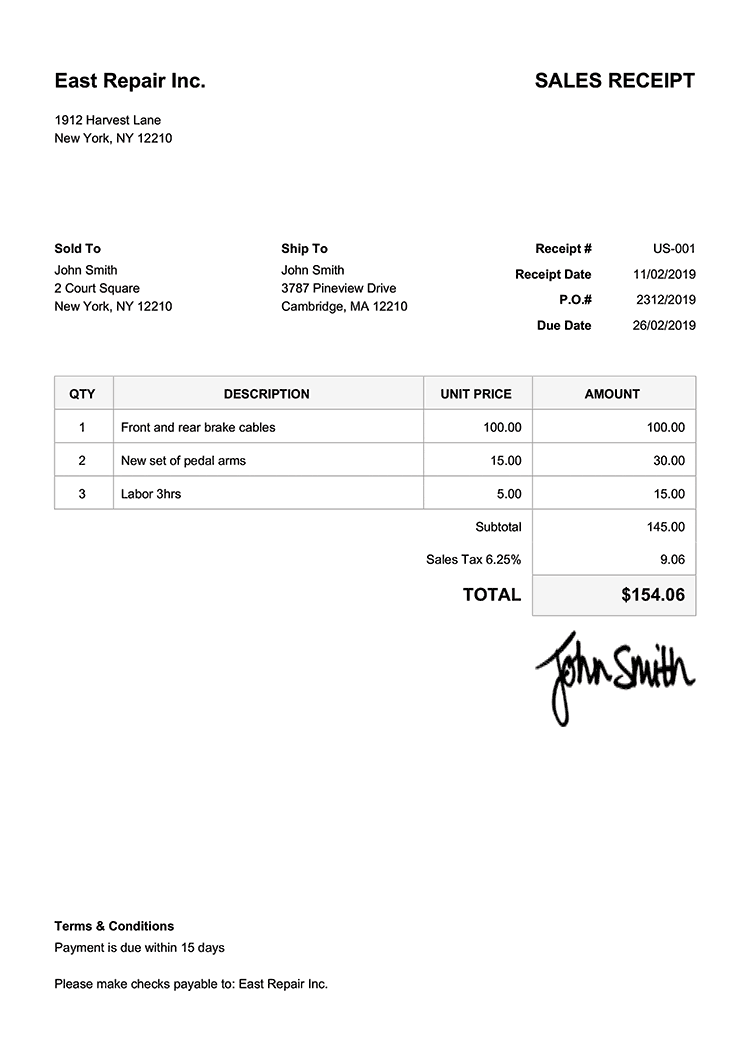

Key Components of a Sales Receipt

Image Source: invoicehome.com

Header: This section usually contains the seller’s name, address, and contact information. It may also include the receipt number, date, and time of the transaction.

Creating a Sales Receipt

While many businesses use specialized software or point-of-sale (POS) systems to generate sales receipts, it’s possible to create a basic receipt using a word processor or spreadsheet. Here’s a general outline:

1. Design: Choose a clean and professional layout. Consider using a table to organize the itemized list.

2. Header: Include the seller’s information, receipt number, date, and time.

3. Itemized List: List each item, quantity, price, and total.

4. Calculations: Calculate the subtotal, taxes, discounts, and total.

5. Payment Information: Specify the payment method.

6. Seller’s Signature: If necessary, include a space for the seller’s signature.

Tips for Effective Sales Receipts

Clarity: Ensure the receipt is easy to read and understand. Use clear fonts and spacing.

Conclusion

Sales receipts are essential documents for businesses and consumers. By following these guidelines, you can create accurate, professional, and informative sales receipts.

FAQs

1. Are sales receipts legally required? While not always mandated by law, sales receipts are often considered good business practice and can be helpful in case of disputes or returns.

2. Can I create a sales receipt using a word processor? Yes, you can create a basic sales receipt using a word processor like Microsoft Word or Google Docs.

3. What should I include in the header of a sales receipt? The header typically includes the seller’s name, address, contact information, receipt number, date, and time.

4. How can I ensure the accuracy of my sales receipts? Double-check all information, including prices and calculations. Use a calculator or accounting software to verify numbers.

5. Can I use sales receipts for tax purposes? Yes, sales receipts can be used as proof of purchases for tax deductions or credits.

Sales Receipt Sample