An LLC Operating Agreement is a legal document that outlines how your limited liability company (LLC) will be managed and operated. It’s essentially a roadmap for your business, providing clarity on important aspects like ownership, decision-making, and profit distribution.

Key Provisions in an LLC Operating Agreement

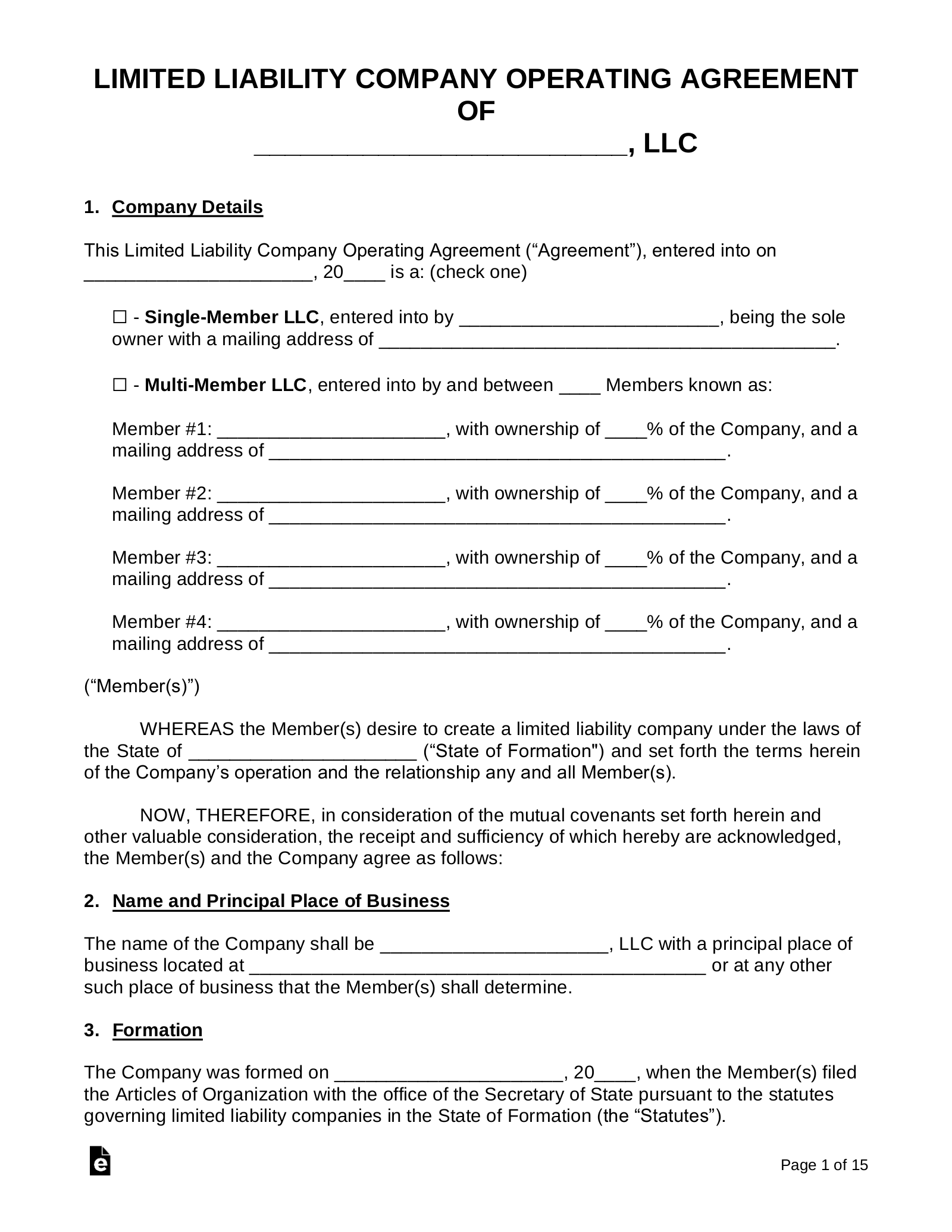

Ownership: This section defines the ownership structure of your LLC, including the names and addresses of members, their ownership percentages, and how new members can be added or removed.

Image Source: eforms.com

Why is an LLC Operating Agreement Important?

An LLC Operating Agreement offers several benefits:

Legal Protection: It helps protect your personal assets from business liabilities.

Conclusion

An LLC Operating Agreement is a crucial document for any business owner. It provides a solid foundation for your LLC, protecting your personal assets, streamlining operations, and facilitating decision-making. By carefully considering the key provisions and tailoring the agreement to your specific needs, you can set your LLC up for success.

FAQs

1. Is an LLC Operating Agreement required by law? While not mandatory in all states, having an operating agreement is highly recommended as it provides legal protection and clarity for your business.

2. Can I draft my own LLC Operating Agreement? While it’s possible, it’s often advisable to consult with an attorney to ensure that your agreement complies with all legal requirements and adequately protects your interests.

3. Can I modify my LLC Operating Agreement after it’s been signed? Yes, you can modify your operating agreement at any time. However, any changes should be made in writing and signed by all members of the LLC.

4. What happens if there is a dispute among members of my LLC? Your operating agreement should outline procedures for resolving disputes, such as mediation or arbitration. If these methods fail, you may need to seek legal assistance.

5. Can I convert my LLC into a corporation? Yes, you can typically convert your LLC into a corporation. However, this process involves filing specific paperwork with your state government and may require amending your operating agreement.

Llc Operating Agreement