What is an Invoice?

An invoice is a formal document that details the goods or services provided, the corresponding costs, and the payment terms. It’s essentially a bill that you send to your customers.

Why is an Invoice Important?

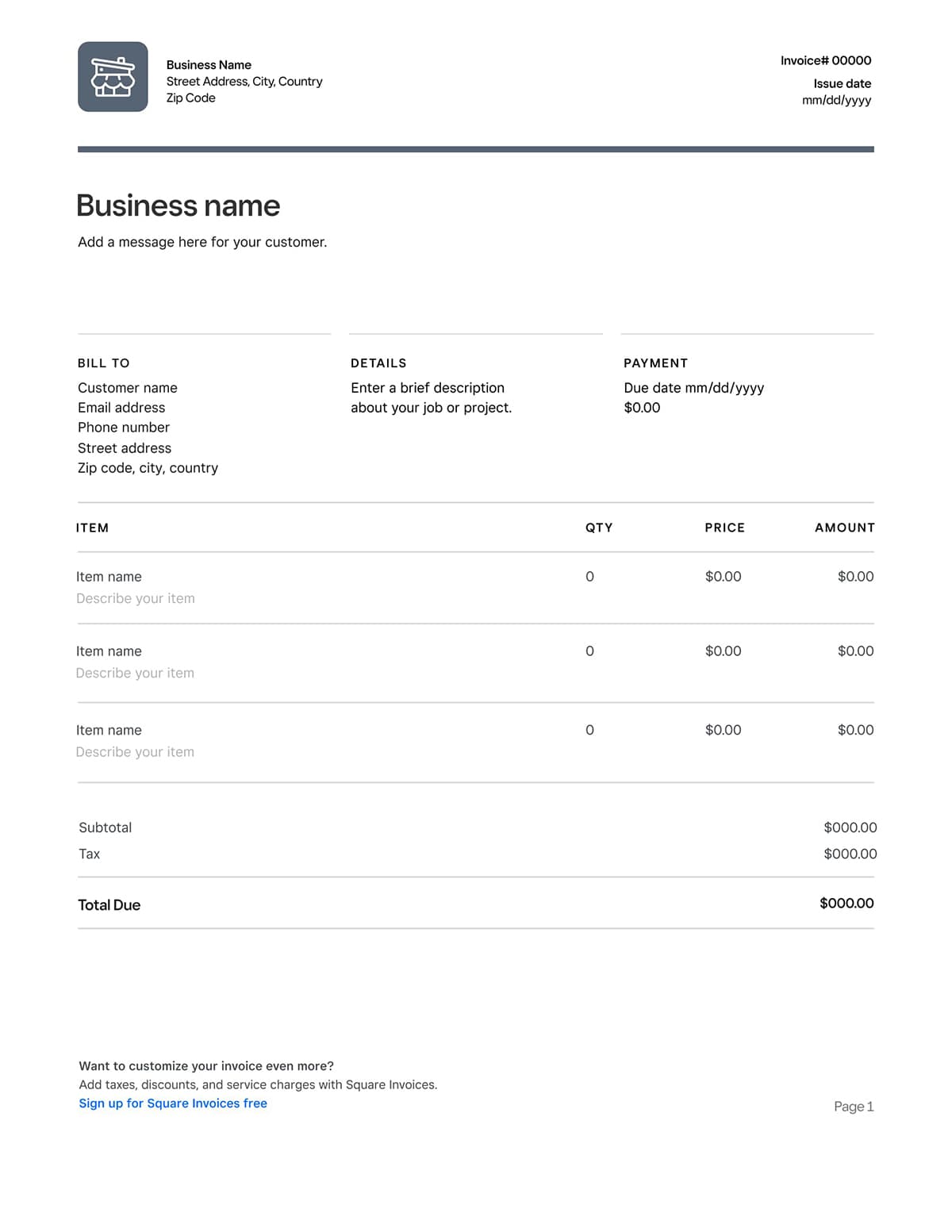

Image Source: amazonaws.com

Legal Record: An invoice serves as a legal record of a transaction.

Essential Elements of an Invoice

1. Your Business Information: Include your company name, address, contact information, and tax identification number.

2. Customer Information: List your customer’s name, address, and contact details.

3. Invoice Number: Assign a unique number to each invoice for easy reference.

4. Invoice Date: Indicate the date the invoice was issued.

5. Due Date: Specify the date by which payment is expected.

6. Itemized List: Clearly list the goods or services provided, their quantity, unit price, and total cost.

7. Subtotal: Calculate the total amount before taxes and discounts.

8. Taxes: If applicable, list any taxes, such as sales tax or VAT, and their amounts.

9. Discounts: If offering discounts, specify them and their amounts.

10. Total Due: Calculate the final amount due after applying taxes and discounts.

11. Payment Terms: Indicate the preferred payment method (e.g., check, credit card) and any additional payment terms.

12. Contact Information: Provide contact details for any inquiries or disputes.

Tips for Creating Effective Invoices

Clear and Concise: Use simple language and avoid technical jargon.

Conclusion

Creating effective invoices is essential for any business. By following these guidelines, you can ensure that your invoices are accurate, professional, and contribute to your business’s success.

FAQs

1. What is the difference between an invoice and a receipt?

2. Can I use a template for my invoices?

3. How often should I send invoices?

4. What should I do if a customer doesn’t pay on time?

5. Can I include additional information on my invoices?

Invoice Template