An invoice receipt is a document that serves as proof of purchase or service rendered. It typically includes detailed information about the transaction, such as the buyer’s and seller’s details, a list of items purchased or services provided, the total cost, and payment terms.

Essential Components of an Invoice Receipt:

Header: This section usually contains the seller’s business name, address, contact information, and the invoice number.

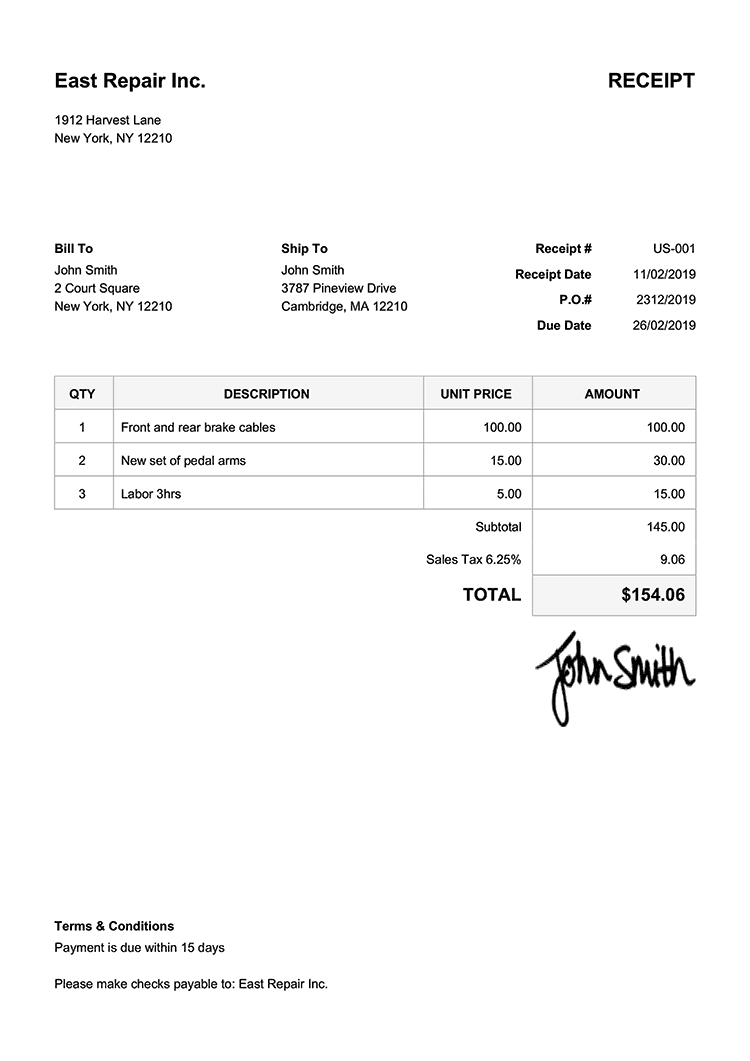

Image Source: invoicehome.com

Types of Invoice Receipts:

Proforma Invoice: Sent before goods or services are delivered, often used for international transactions.

Creating an Invoice Receipt:

1. Gather Information: Collect necessary details about the transaction, including customer information, product/service details, and payment terms.

2. Design the Layout: Choose a professional template or create your own layout using software like Microsoft Word or Excel.

3. Fill in the Details: Accurately enter all relevant information into the invoice.

4. Calculate Totals: Ensure that the subtotal, taxes, discounts, and total are calculated correctly.

5. Review and Verify: Double-check the invoice for errors or omissions before sending it to the customer.

Conclusion:

An invoice receipt is a crucial document for businesses and their customers. It provides a clear record of the transaction and helps to manage finances effectively. By understanding the essential components and types of invoice receipts, you can create accurate and professional invoices that meet your business needs.

FAQs:

1. What is the difference between an invoice and a receipt?

2. Can I create an invoice receipt using a spreadsheet software like Excel?

3. Is it necessary to include a company logo on an invoice receipt?

4. What is the best way to store invoice receipts?

5. Can I issue a corrected invoice receipt if I made a mistake on the original invoice?

Example Of Invoice Receipt