Consulting Invoice

A consulting invoice is a formal document that details the services provided by a consultant to a client, along with the corresponding fees. It’s essentially a bill for the work done.

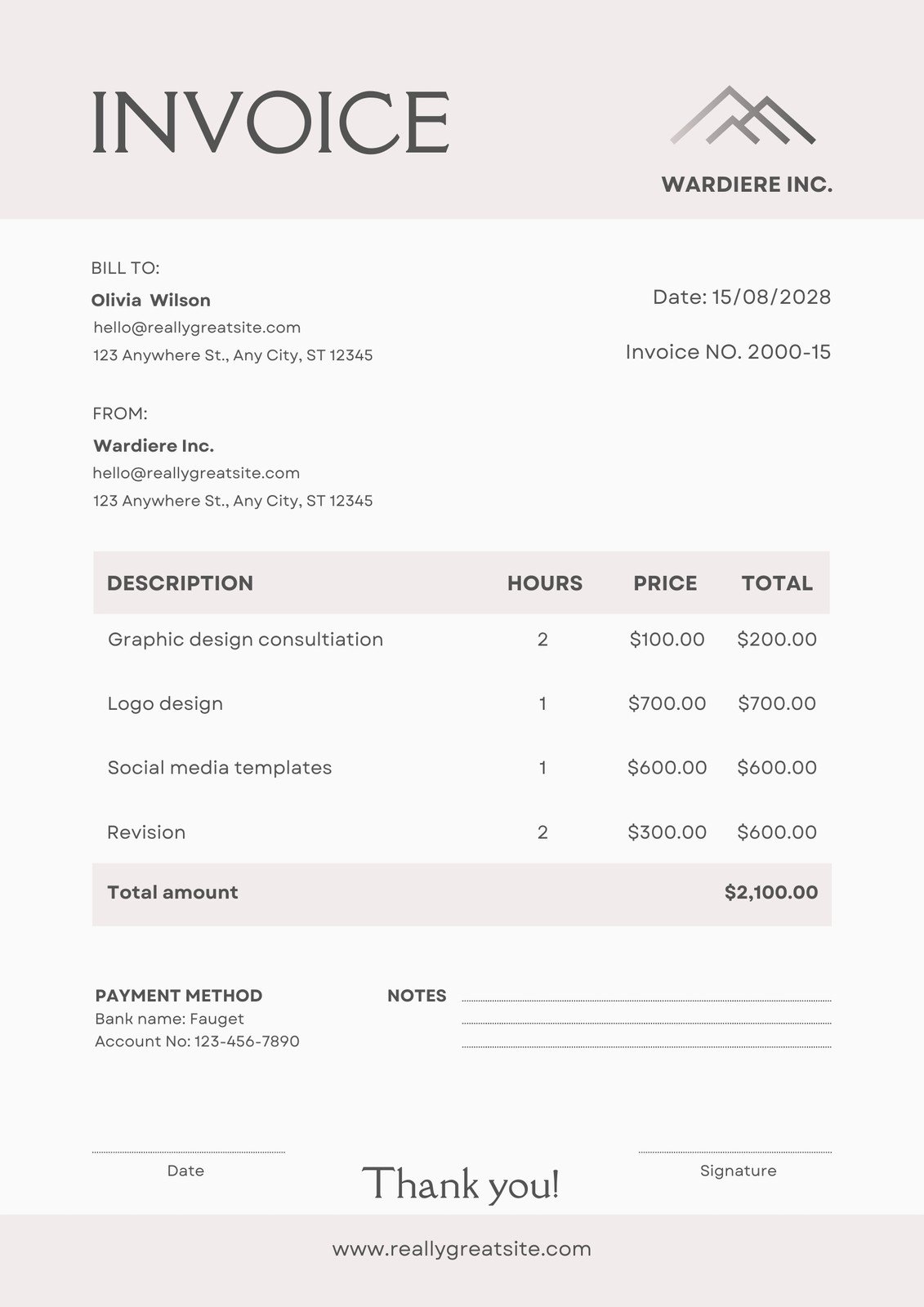

Here’s a basic example of a consulting invoice:

Image Source: canva.com

Client Information:

Consultant Information:

Invoice Number: [Unique Invoice Number]

Invoice Date: [Date of Invoice]

Due Date: [Date Payment is Due]

Itemized Description of Services:

Subtotal: [Total of Services]

Tax: [Applicable Tax Amount]

Total Due: [Subtotal + Tax]

Payment Terms: [Terms for Payment, e.g., Net 30 Days]

Signature: [Your Signature]

Note: This is a basic template. You may need to add more details depending on your specific requirements and local regulations.

Key Elements of a Consulting Invoice:

Client and Consultant Information: Clearly state the details of both parties involved.

Tips for Creating Effective Consulting Invoices:

Conclusion

A well-structured consulting invoice is essential for professional billing and client satisfaction. By following the guidelines outlined above, you can create clear, accurate, and professional invoices that reflect the value of your services.

FAQs

1. What is the best way to track consulting invoices? You can use a dedicated invoicing software or a spreadsheet to track your invoices and payments.

2. Can I include additional charges on a consulting invoice? Yes, you can include additional charges such as travel expenses, materials, or late fees if applicable.

3. How often should I send consulting invoices? It’s generally recommended to send invoices monthly or weekly, depending on your client’s preference and the nature of your work.

4. What should I do if a client disputes an invoice? If a client disputes an invoice, review the details carefully and address their concerns promptly and professionally.

5. Can I offer discounts or payment plans to clients? Yes, you can offer discounts or payment plans to clients if you believe it will benefit your business.

Consulting Invoice Example