What is a Business Bill?

A business bill is a formal document that details the goods or services provided by a seller to a buyer, along with the corresponding costs. It’s essentially an invoice that outlines the transaction.

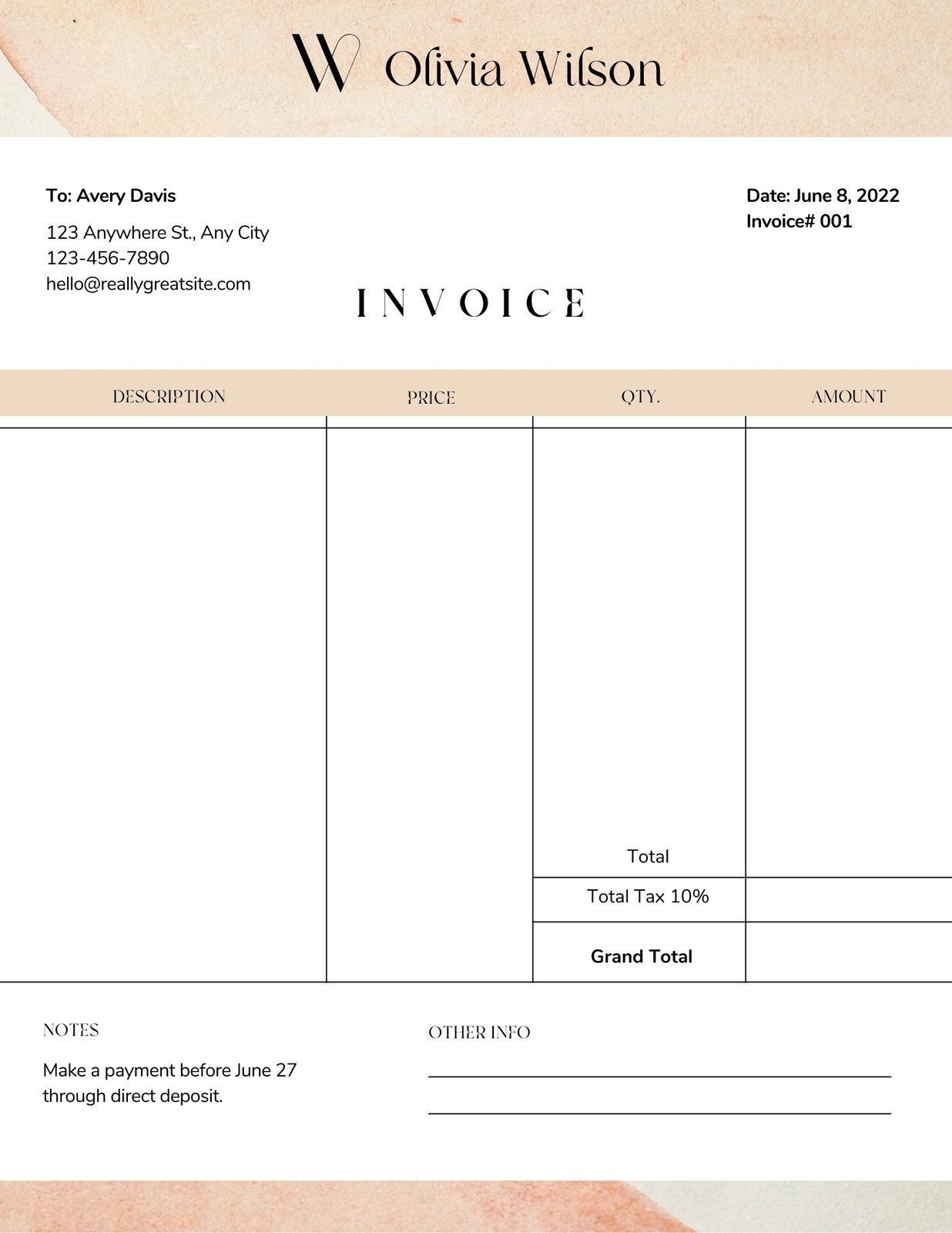

Key Components of a Business Bill

Image Source: canva.com

1. Header:

2. Recipient Information:

3. Itemized List of Goods or Services:

4. Subtotals and Taxes:

5. Payment Terms:

6. Additional Notes:

Conclusion

A well-formatted business bill is essential for clear communication and efficient transactions. By following the guidelines outlined above, you can create professional and easy-to-understand invoices that help you manage your finances effectively.

FAQs

1. What is the difference between a bill and an invoice? While the terms “bill” and “invoice” are often used interchangeably, an invoice is generally a more formal document that outlines a commercial transaction between a seller and a buyer.

2. Can I include additional information on a business bill? Yes, you can include additional information, such as purchase order numbers, project names, or specific terms and conditions.

3. How often should I send business bills? The frequency of sending business bills depends on your industry and business practices. However, it’s generally recommended to send bills promptly after goods or services are delivered.

4. What should I do if a customer disputes a bill? If a customer disputes a bill, it’s important to review the details carefully and address any concerns promptly. You may need to provide additional documentation or make adjustments to the bill.

5. Are there any software tools that can help me create business bills? Yes, there are many software tools available that can help you create professional-looking business bills, such as accounting software and online invoicing platforms.

Business Bill Format