Blank Invoice Template: A Comprehensive Guide

A blank invoice is a foundational document in any business transaction. It serves as a formal record of goods or services provided, outlining the quantity, price, and total amount due. Creating a well-structured invoice is crucial for effective bookkeeping, tax compliance, and maintaining professional business relationships.

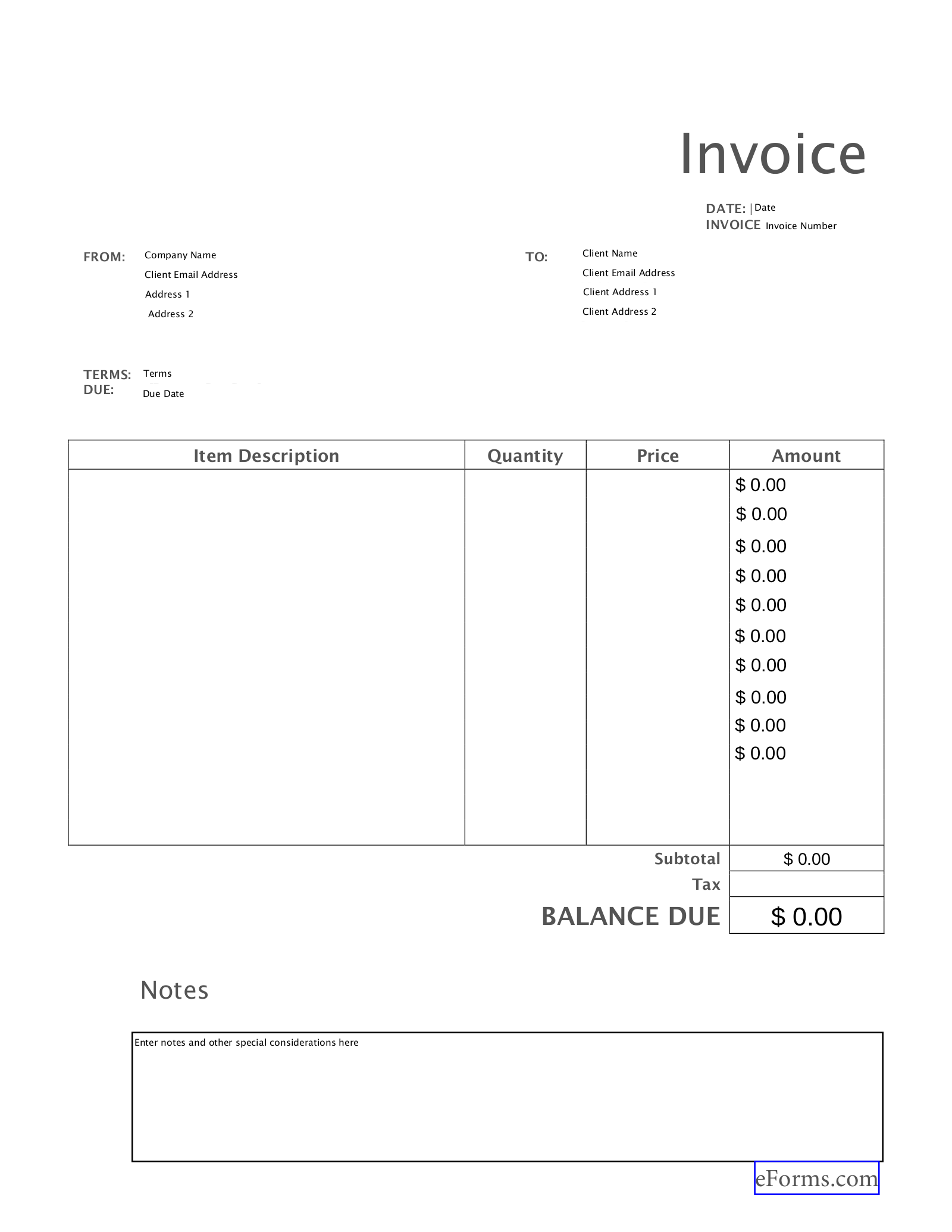

Image Source: eforms.com

To ensure your invoice is clear, concise, and legally sound, include the following essential elements:

1. Invoice Number: A unique identifier for each invoice.

2. Invoice Date: The date the invoice is issued.

3. Seller Information: Your business name, address, contact details, and tax identification number (if applicable).

4. Customer Information: The customer’s name, address, and contact details.

5. Invoice Terms: The payment terms, such as due date, payment methods, and any late fees or penalties.

6. Itemized List: A detailed breakdown of the goods or services provided, including quantity, description, unit price, and total cost.

7. Subtotal: The total amount before taxes and discounts.

8. Taxes: Any applicable taxes, such as sales tax or VAT.

9. Discounts: Any discounts or promotions applied.

10. Total Due: The final amount owed by the customer.

Here are some tips for creating a professional and effective invoice:

1. Use a Template: Utilize a pre-designed invoice template to streamline the process and ensure consistency.

2. Clear and Concise Language: Avoid jargon and use simple, straightforward language.

3. Accurate Information: Double-check all details to avoid errors.

4. Professional Layout: Use a clean and organized layout that is easy to read.

5. Branding: Incorporate your business logo and branding elements to enhance professionalism.

A well-crafted blank invoice is an essential tool for any business. By following the guidelines outlined in this guide, you can create invoices that are professional, accurate, and legally compliant. Effective invoice management contributes to efficient bookkeeping, improved cash flow, and stronger customer relationships.

1. What is the difference between an invoice and a receipt? An invoice is a document issued before or after the sale, while a receipt is typically issued after payment is received.

2. Can I create an invoice using a word processor? Yes, you can create an invoice using a word processor like Microsoft Word or Google Docs. However, using a dedicated invoice template can save time and ensure accuracy.

3. What should I do if a customer disputes an invoice? If a customer disputes an invoice, review the details carefully and address any concerns promptly. Provide supporting documentation if necessary.

4. How often should I send invoices to customers? The frequency of invoice sending depends on your business terms and industry standards. Generally, invoices are sent monthly or weekly, depending on the nature of the services or products provided.

5. Can I include additional information on an invoice? Yes, you can include additional information on an invoice, such as purchase order numbers, shipping information, or special instructions.

Blank Invoice