Blank Check Template: A Comprehensive Guide

A blank check template is a versatile document that can be used for various purposes, from personal to business transactions. It provides a structured format for writing checks, ensuring accuracy and clarity. In this guide, we’ll delve into the essential elements of a blank check template, its different types, and how to use it effectively.

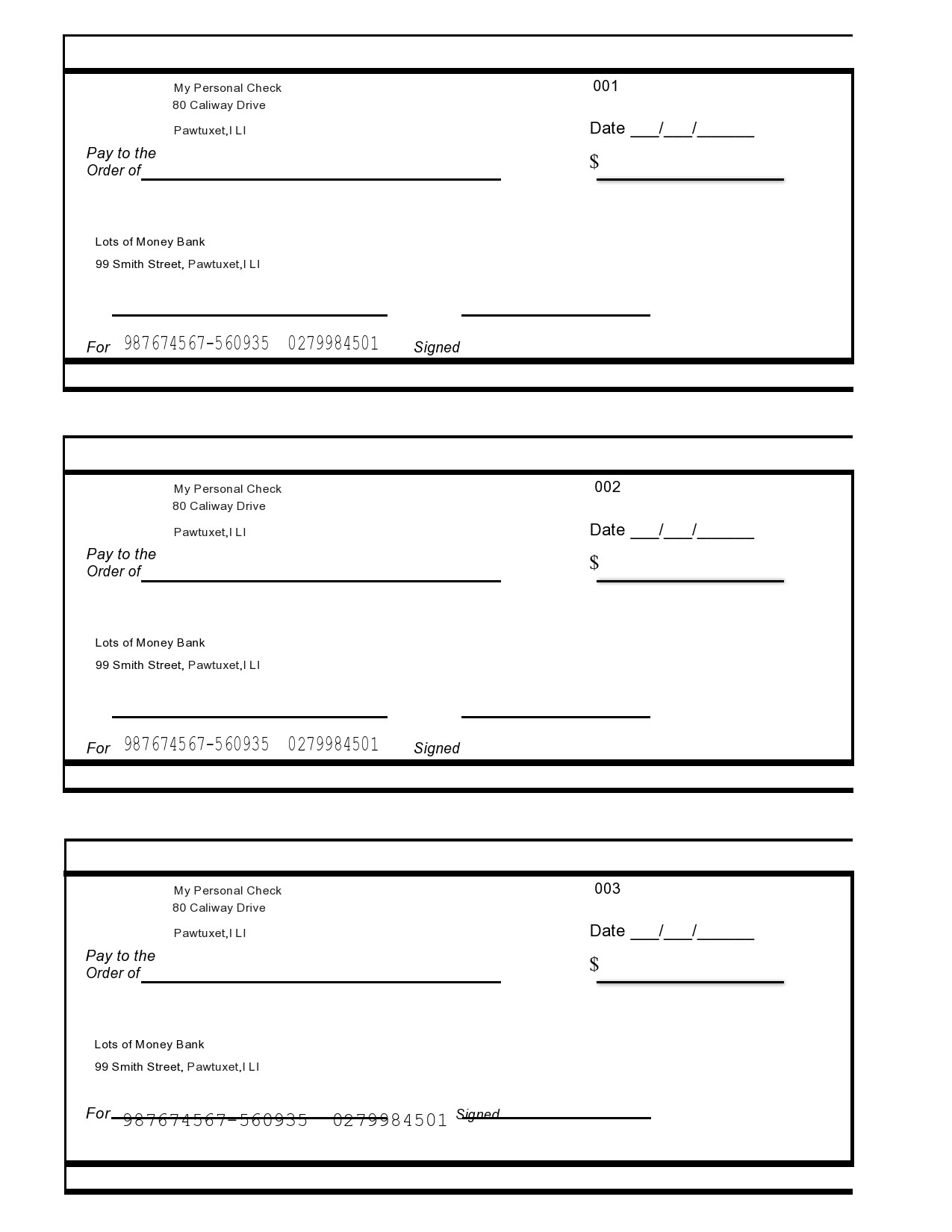

Image Source: templatelab.com

A blank check template typically includes the following components:

Payee Line: This is where you write the name of the person or entity you’re paying.

There are several types of blank check templates available, each designed for specific purposes:

Personal Checks: These are used for personal transactions, such as paying bills or making purchases.

1. Obtain a Blank Check: You can get blank checks from your bank or financial institution.

2. Fill in the Details: Carefully fill in the payee, date, amount, memo, and signature lines.

3. Double-Check: Ensure that all information is accurate and complete before signing.

4. Detach the Check: If necessary, detach the check from the stub for record-keeping purposes.

Blank check templates are essential tools for managing personal and business finances. By understanding the different types of templates and following the guidelines for using them, you can ensure accurate and efficient financial transactions.

1. What is the difference between a personal check and a business check?

Personal checks are used for personal transactions, while business checks are used by businesses for financial transactions.

2. Can I use a blank check template for online payments?

No, blank check templates are primarily used for physical checks. Online payments typically require different methods, such as credit cards or electronic funds transfers.

3. Is it safe to use a blank check template?

Yes, blank check templates are generally safe when used correctly. However, it’s important to protect your checks from unauthorized access and to report any lost or stolen checks to your bank immediately.

4. Can I customize a blank check template?

Some banks offer options for customizing check templates, such as adding a personal logo or design. However, the essential elements of the template must remain unchanged.

5. What should I do if I make a mistake on a blank check?

If you make a mistake on a check, it’s best to void it by writing “VOID” across the front. Contact your bank to report the voided check and request a new one.

Blank Check Template